A sea of aspirants is eagerly waiting for the RBI Grade B 2025 notification. If you are one of them, instead of waiting for the official announcement and getting stressed, you should start preparing for the RBI Grade B 2025 exam right now. And start with the understanding that every subject is important, such as Finance, which comes under the RBI Grade B Finance and Management part of Phase 2, paper 3. This important part requires dedicated and smart preparation. Therefore, you must understand its syllabus well and adopt an effective strategy to clear this paper. Hence, we have broken down the syllabus, analyzed 2023-2024 questions, and discussed the topics below, which, if you master well, will allow you to perform confidently in this part of the exam and succeed.

Also, know why RBI Grade B Phase 1 Exam: The Silent Eliminator of 99% Aspirants & What is the Finance and Management Syllabus for RBI Grade B Exam?

RBI Grade B Phase 2 Exam Pattern and Finance Syllabus

Before we move on to the important topics or those that were asked in 2023-2024, we must first take a look at the exam pattern and syllabus.

RBI Grade B Phase 2 Exam Pattern:

Finance, which is part of Phase 2 (Paper III) comes under the head of Finance, Management, and Ethics. It evaluates candidates’ financial knowledge through finance-related questions. In this, 50 percent of the questions are of an objective nature, and 50 percent are descriptive type. For descriptive questions, you will have to type your answers using a keyboard, meaning not with pen and paper. You also have the option to type in Hindi, if you don’t feel comfortable typing in English. Check out the table below to learn about the test format, total duration, and maximum number of marks it offers.

| RBI Grade B Phase 2 Exam Pattern (General Post) | |||

| Paper | Format | Duration | Marks |

| Paper-I: Economic & Social Issues | Objective (50%) | 30 Minutes | 50 |

| Descriptive (50%) | 90 Minutes | 50 | |

| Paper-II: English (Writing Skills) | Descriptive (3 Questions) | 90 Minutes | 100 |

| Paper III: Finance, Management, and Ethics | Objective (50%) | 30 Minutes | 50 |

| Descriptive (50%) | 90 Minutes | 50 | |

General Finance Syllabus:

The better and deeper you understand the syllabus, the better you will be able to understand which topics you need to cover. Once you are aware of this and learn about the previous years’ questions, you will begin to get an idea of what kind of questions might come from which topic in the exam. The same applies to General Finance. Therefore, you must first take a good look at the General and Finance syllabus and then take the first mock test. The mock test will highlight your weaknesses and strengths. And based on that, you can speed up your preparation. For this, you can opt for any of the courses introduced in this blog, whichever suits you the best.

Financial System

- Structure and Functions of Financial Institutions

- Functions of Reserve Bank of India

- Banking System in India – Structure and Developments, Financial Institutions – SIDBI, EXIM Bank, NABARD, NHB, NaBFID, etc.

- Recent Developments in Global Financial System and its impact on Indian Financial System

- Role of Information Technology in Banking and Finance

- Non-Banking System

- Developments in Digital Payments

Financial Markets: Primary and Secondary Markets (Forex, Money, Bond, Equity, etc.), functions, instruments, and recent developments.

You might also like to know How to Become RBI Grade B Officer? & When Will RBI Grade B 2025 Notification Come?

General Topics

General topics are the basic topics that you should have mastered before delving deeper into the other topics. These are the topics without which neither your foundation of finance will solidify nor the speed of your preparation will pick up. Here are the topics that you need to be proficient in to speed up your preparation further and get good results.

- Financial Risk Management

- Basics of Derivatives

- Global financial markets and International Banking – broad trends and latest developments

- Financial Inclusion

- Alternate source of finance, private and social cost-benefit, Public-Private Partnership

- Corporate Governance in Banking Sector

- The Union Budget: Concepts, approach, and broad trends

- Basics of Accounting and Financial Statements: Balance Sheet, Profit and Loss, Cash Flow Statements, Ratio Analysis (such as Debt to Equity, Debtor Days, Creditor Days, Inventory Turnover, Return on Assets, Return on Equity, etc.)

- Inflation: Definition, trends, estimates, consequences and remedies (control): WPI- CPI – components and trends; striking a balance between inflation and growth through monetary and fiscal policies

Descriptive Questions: PYQs 2023

In 2023, descriptive questions came from RBI’s schemes. Apart from this, ONDC (Open Network for Digital Commerce) also attracted questions, which were related to its features and the companies associated with it.

- Explain in detail, RBI’s Retail Direct Scheme including the scope, applicability, charges, fees, etc.

- Describe ONDC. How will it impact companies like Amazon, Flipkart, Walmart, etc?

- What are Pre-Sanctioned Credit Lines at Banks through the UPI? How is it going to help in furthering Financial Inclusion?

Descriptive Questions: PYQs 2024

Similarly, if we talk about the Finance part of the 2024 RBI Grade B exam, then questions related to Bonds, Investing (Value, growth, etc.), or derivatives attempt to thoroughly test candidates’ Financial General knowledge.

Here are the questions that tested the candidates’ descriptive writing skills in the year 2024:

- AT-1 Bonds (400 words)

- Value vs Growth Investing (400 words)

- Types of Derivatives (600 words)

Objective (2023 and 2024)

We’ll now throw light on the 2-marker and 1-marker questions that appeared in the general Finance part of the exam in 2023.

2 Markers:

- Paragraph on PM Jan Dhan

- Small Finance Banking regulation

1 Marker Questions:

- Calculate RoA

- NabFID

- LRS limit

- Bills on Exchange

- Which of the following is non-tax revenue?

2024:

2 Markers Questions:

- Paragraph based on SDGs

- Paragraph on Planetary Bodies

- SEBI circular

- 1 Markers

- T+3 days

- REIT limit 50 crore

- Ways and Means advances – 50,000 crore

- NBFC Credit and Market Risks

General Finance Course Structure and Important Topics

In many competitive exams, some topics attract questions in the exam again and again. But that’s not the case with the RBI Grade B exam, or specifically in the General Finance part of Paper 2. You need to go through every topic carefully, and practice as many related questions as possible. However, all the topics related to this subject that are part of the syllabus are important, some topics are more important than others. The table below represents all these topics. While all topics are important, the ones highlighted in bold are especially significant.

| Topics | |

| 1. Financial Management and System | 15. Information Technology in Banking and Finance |

| 2. Indian Financial System and Regulation | 16. Financial Risk and Management |

| 3. Financial Markets | 17. Financial Statement Analysis and Ratios |

| 4. Capital Market | 18. Cash Flow and Fund Flow |

| 5. Money Market | |

| 6. Forex Market | |

| 7. Banking System and Global Standards | |

| 8. Alternative Source of Finance | |

| 9. Taxation – Direct and Indirect | |

| 11. Inflation | |

| 12. Recent Development in Financial Sector | |

| 13. Financial Inclusion | |

| 14. Basics of Accounting |

Why Take RBI Grade B Phase 2 Test Series to Master Finance

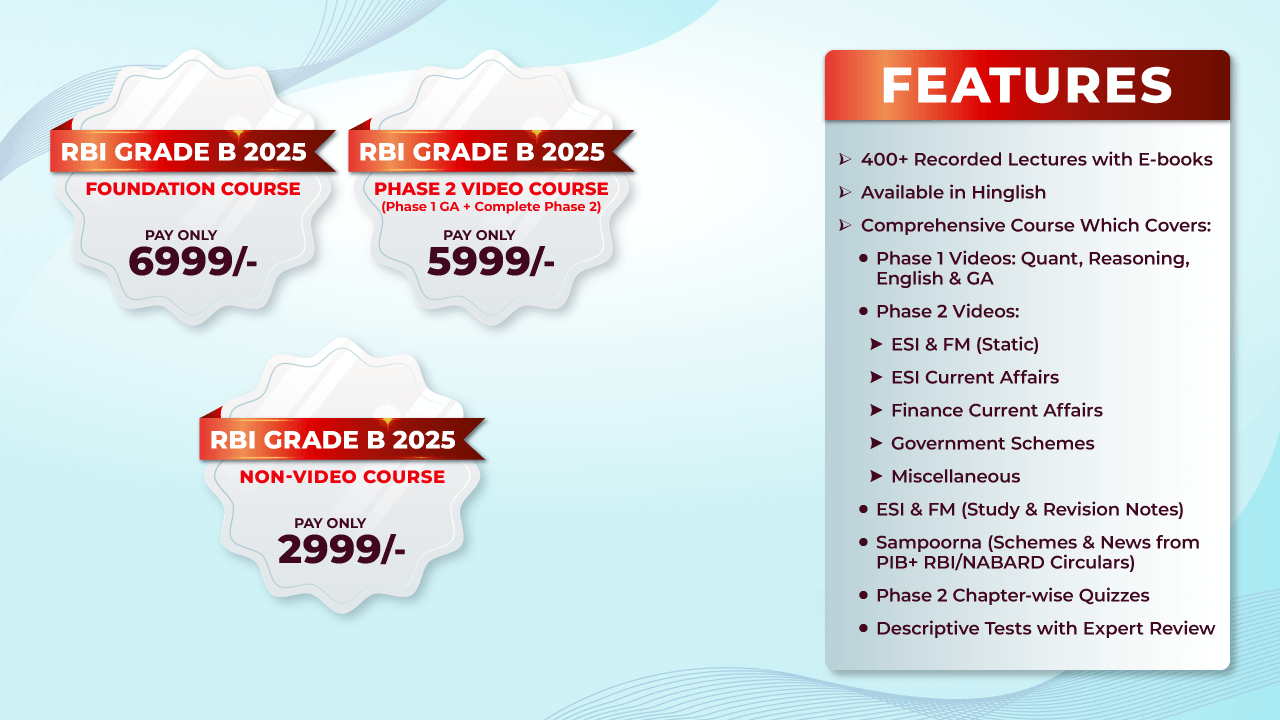

It is essential to embrace a result-oriented Mock Test series that covers the RBI Grade B Phase 1 and 2 syllabus, to get tested with finance-related questions and get the best feedback needed for quick improvement. PracticeMock is a podium that provides multiple RBI Grade B courses packed with exam-like mock tests. You can choose one of the courses that best suits your pocket or purpose. Below we have linked the latest courses that you can choose from. You get a plethora of benefits after getting one of the three best courses mentioned below. For instance, it’s home to hundreds of recorded lectures with E-books, and complete coverage of Phase 1 and Phase 2 through videos. It also contains ESI and FM study and revision notes. And what’s more? You get chapter-wise quizzes and descriptive tests with expert feedback. Plus, it gives thorough coverage of current affairs. How, you may ask? The answer is, through:

- Sampoorna Magazine + Sampoorna Questions

- Monthly Current Affairs Videos

- Reports summaries of:

- Currency and Finance

- Financial Stability Report

- Annual Report of RBI

- Budget

- Economic Survey

- Sustainable Development Report

And more! So, what are you waiting for then? Hurry up, grab the course that is most suitable for you!

Sample Questions from the RBI Grade B 2025 Mock Tests

What if you had the opportunity to practice as if you were sitting in the real RBI Grade B exam? With each test, your knowledge will grow, weaknesses will become apparent, you’ll work on eliminating those weaknesses, your confidence will increase, and you’ll gain many more benefits. To bring all these advantages to you, we have had these mock tests designed by our subject experts.

Here are some sample questions from the mock tests to give you an idea about the types of questions you’ll face to practice the real exam scenario:

Also, go through RBI Grade B ESI Preparation Strategy

- Sign Up on Practicemock for Updated Current Affairs, Free Topic Tests and Free Mini Mocks

- Sign Up Here to Download Free Study Material

Free Mock Tests for the Upcoming Exams

- IBPS PO Free Mock Test

- RBI Grade B Free Mock Test

- IBPS SO Free Mock Test

- NABARD Grade A Free Mock Test

- SSC CGL Free Mock Test

- IBPS Clerk Free Mock Test

- IBPS RRB PO Free Mock Test

- IBPS RRB Clerk Free Mock Test

- RRB NTPC Free Mock Test

- SSC MTS Free Mock Test

- SSC Strenographer Free Mock Test

- GATE Mechanical Free Mock Test

- GATE Civil Free Mock Test

- RRB ALP Free Mock Test

- SSC CPO Free Mock Test

- AFCAT Free Mock Test

- SEBI Grade A Free Mock Test

- IFSCA Grade A Free Mock Test

- RRB JE Free Mock Test

- Free Banking Live Test

- Free SSC Live Test