This segment aims for better preparation by asking static questions based on the topics covered in Mint newspaper. It has been observed that even static questions in Phase II (Economic and Social Issues, and Finance) of RBI Grade B and both phases of NABARD Grade A are hugely influenced by the topics in the news. On that note, please attempt the quizzes and evaluate where you stand.

Below we will be providing the mint statica for 25th August, 2023.

RBI Grade B Free Mock Test 2023

Mint StatiCA MCQs – Sep 05, 2023

A. Several bank accounts can be linked to the same virtual address.

B. Initial Public Offering and Retail Direct Scheme the limit of UPI is up to Rs 5 lakh per transaction.

C. For normal UPI the transaction limit is up to Rs 1 Lakh per transaction.

1) Only A

2) Both B and C

3) Both A and B

4) Only C

5) All A, B and C

Ans: 5

Solution:

Unified Payments Interface (UPI) is an instant payment system developed by the National Payments Corporation of India (NPCI), an RBI regulated entity. UPI is built over the IMPS infrastructure and allows you to instantly transfer money between any two parties’ bank accounts.

Several bank accounts can be linked to the same virtual address depending on the functionalities being made available by the respective PSPs.

For normal UPI the transaction limit is up to Rs 1 Lakh per transaction. For few specific categories of transaction in UPI like Capital Markets, Collections, Insurance, Foreign Inward Remittances the transaction limit is up to 2 lakh and for Initial Public Offering and Retail Direct Scheme the limit is up to Rs 5 lakh per transaction.

1) All essential commodities are covered under the stock limits and hoarding.

2) Central Government decides stock limits for essential commodities.

3) States can constitute Special Courts for the cases to be tried under the EC Act.

4) For perishable commodities MRP is decided.

5) All of the above

Ans: 3

Solution:

A commodity included in the schedule to the Essential Commodities Act 1955 is an essential commodity under the Act and for the Prevention of Black Marketing and Maintenance of Supplies of Essential Commodities Act 1980. For terming a stock as hoarding the State Government must issue stock limits orders under the EC Act. Any quantity of a commodity covered in the order kept in violation of that order is termed as hoarding. If no stock limits are imposed, there is no question of hoarding in that commodity.

Whenever there are pressing reasons to arrest unfair price rise of any essential commodity, the Union Government empowers State Governments and Union Territories, by way of notifying orders under the EC Act, to decide stock limits and notify after approval of the Union Government.

The States have inherent powers to constitute Special Courts for any kind of offences in consultation with the concerned High Court.

For non-perishable commodities MRP is decided. For perishable commodities, it is for the State/UT to regulate prices to ensure minimum gap between selling price of producer/manufacturer and retail price.

1) It provides accidental insurance of Rs 1 Lakh.

2) Overdraft facility of Rs 5000 to a single account holder of a family.

3) Overdraft facility is activated after 3 months of satisfactory operations.

4) Life Insurance of Rs 30,000 is available to the account holders.

5) None of the above

Ans: 3

Solution:

PM Jan Dhan Yojana

• Interest on deposits.

• Accidental insurance cover of Rs.1 lakh.

• No minimum balance required.

• Under Pradhan Mantri Jan Dhan Yojana, life insurance of Rs 30,000 will be payable to the beneficiary on his death on reimbursement of normal conditions.

• Easy transfer of funds across India.

• Beneficiaries of government schemes will receive benefit transfer from these accounts.

• Overdraft facility will be provided after satisfactory operation of these accounts for six months.

• Access to pension, insurance products.

• Overdraft facility up to Rs.5,000/- is available in only one account per household, preferably for the women of the household.

Identify (A)!

1) Rs 3210 crores

2) Rs 4380 crores

3) Rs 2200 crores

4) Rs 1430 crores

5) Rs 4340 crores

Ans: 3

Solution:

Atmanirbhar clean plant program launched with an outlay of Rs. 2,200 crores to boost availability of quality planting material for high value horticultural crops.

A. The FI-Index constructed by the Reserve Bank is based on the three dimensions of financial inclusion, viz., ‘Access’, ‘Usage’ and ‘Quality’.

B. Lowest weight is given to the Quality dimension.

C. There are total 97 indicators in the Financial Inclusion Index.

1) Only A

2) Both B and C

3) Only C

4) Both A and B

5) None of the above

Ans: 5

Solution:

Greater financial inclusion (FI) is crucial for a wider, inclusive and sustainable growth. Therefore, a measure of FI is necessary to effectively monitor the progress of the policy initiatives undertaken to promote FI. A multidimensional composite Financial Inclusion Index (FI-Index) has been constructed based on 97 indicators which quantifies the extent of financial inclusion and is responsive to availability, ease of access, usage, unequal distribution and deficiency in services, financial literacy, and consumer protection.

The FI-Index constructed by the Reserve Bank is based on the three dimensions of financial inclusion, viz., ‘Access’, ‘Usage’ and ‘Quality’ with weights as 35, 45 and 20 per cent respectively.

Mint StatiCA MCQs – Sep 04, 2023

A. Connection cannot be released if there is no adult female member.

B. Customer need not pay anything while taking LPG connection under Ujjwala 2.0.

C. 14-point declaration is mandatory to be submitted by all applicants.

1) Only A

2) Both B and C

3) Both A and B

4) Only C

5) All A, B and C

Ans: 5

Solution:

The 14-point declaration submitted by the applicant is the basic criteria to consider it as eligible Poor household under UJJWALA 2.0. Thus, it is mandatory for all applicants.

Under Ujjwala 2.0, OMCs will be providing LPG stove and First Refill at free of Cost to the customer. Hence, Customer need not pay anything while taking LPG connection under Ujjwala 2.0.

PMUY connection can be released in the name of adult female member of the Poor household only.

A. Angel Investor should have net tangible assets of at least 2 crores.

B. Angel funds shall accept, up to a maximum period of 3 years, an investment of not less than 25 lakhs from an angel investor.

C. Angel investor, if a body corporate, have a net worth of at least ten crore rupees.

1) Only A

2) Both A and B

3) Both B and C

4) Both A and C

5) All of the above

Ans: 5

Solution:

“Angel fund” is a sub-category of Venture Capital Fund under Category I Alternative Investment Fund that raises funds from angel investors and invests in accordance with the provisions of Chapter III-A of AIF Regulations. In case of an angel fund, it shall only raise funds by way of issue of units to angel investors. “Angel investor” means any person who proposes to invest in an angel fund and satisfies one of the following conditions, namely, (a) an individual investor who has net tangible assets of at least two crore rupees excluding value of his principal residence, and who: (i) has early stage investment experience, or (ii) has experience as a serial entrepreneur, or (iii) is a senior management professional with at least ten years of experience; (‘Early stage investment experience’ shall mean prior experience in investing in start-up or emerging or early-stage ventures and ‘serial entrepreneur’ shall mean a person who has promoted or co-promoted more than one start-up venture.) (b) a body corporate with a net worth of at least ten crore rupees; or (c) an AIF registered under these regulations or a VCF registered under the SEBI (Venture Capital Funds) Regulations, 1996. Angel funds shall accept, up to a maximum period of 3 years, an investment of not less than `25 lakh from an angel investor.

1) It provides accidental insurance of Rs 1 Lakh.

2) Overdraft facility of Rs 5000 to a single account holder of a family.

3) Overdraft facility is activated after 3 months of satisfactory operations.

4) Life Insurance of Rs 30,000 is available to the account holders.

5) None of the above

Ans: 3

Solution:

PM Jan Dhan Yojana

• Interest on deposits.

• Accidental insurance cover of Rs.1 lakh.

• No minimum balance required.

• Under Pradhan Mantri Jan Dhan Yojana, life insurance of Rs 30,000 will be payable to the beneficiary on his death on reimbursement of normal conditions.

• Easy transfer of funds across India.

• Beneficiaries of government schemes will receive benefit transfer from these accounts.

• Overdraft facility will be provided after satisfactory operation of these accounts for six months.

• Access to pension, insurance products.

• Overdraft facility up to Rs.5,000/- is available in only one account per household, preferably for the women of the household.

Identify (A) and (B) respectively!

1) 350, 325

2) 350, 250

3) 300, 250

4) 300, 255

5) None of the above

Ans: 4

Solution:

With a focus on developing a “technologically advanced and globally competitive steel industry that promotes economic growth”, Shri Jyotiraditya M. Scindia highlighted the targets set by NSP 2017, which will take the steel sector to new heights. He mentioned that India has set the targets of achieving the total crude steel capacity of 300 MTPA and total crude steel demand/production of 255 MTPA by 2030-31. By 2030-31, it is also envisaged to enhance the operational capacity of crude steel production of SAIL from existing 19.51 MTPA to around 35.65 MTPA tentatively.

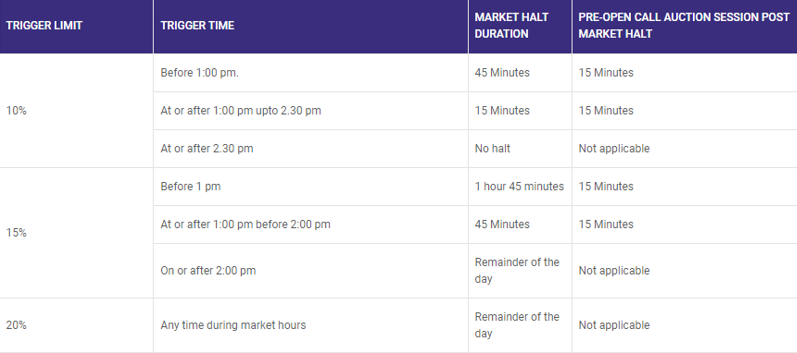

1) 5%

2) 10%

3) 15%

4) 20%

5) None of the above

Ans: 2

Solution:

The Minimum limit is 10%.

Mint StatiCA MCQs – Sep 01, 2023

A. NBFC cannot accept demand deposits.

B. Deposit Insurance facility of Deposit Insurance and Credit Guarantee Corporation is available to depositors of NBFCs.

C. NBFCs do not form part of the payment and settlement system.

1) Only A

2) Both B and C

3) Both A and B

4) Only C

5) Both A and C

Ans: 5

Solution:

NBFCs lend and make investments and hence their activities are akin to that of banks; however there are a few differences as given below:

i. NBFC cannot accept demand deposits;

ii. NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself;

iii. deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of banks.

A. Presently, there are four CICs.

B. Every Credit Institution shall become member of at least one CIC.

C. The annual fees charged by the CICs to CIs shall not exceed Rs.5000 each.

1) Only A

2) Both A and B

3) Both B and C

4) Both A and C

5) All of the above

Ans: 5

Solution:

Presently, four CICs, viz. Credit Information Bureau (India) Limited, Equifax Credit Information Services Private Limited, Experian Credit Information Company of India Private Limited and CRIF High Mark Credit Information Services Private Limited have been granted Certificate of Registration by RBI. In terms of Section 15 of the Credit Information Companies (Regulation) Act, 2005 (CICRA), every Credit Institution shall become member of at least one CIC. Further, Section 17 of CICRA stipulates that a CIC may seek and obtain credit information from its members (Credit Institution / CIC) only.

one-time membership fee charged by the CICs, for CIs to become their members, shall not exceed Rs.10,000 each. The annual fees charged by the CICs to CIs shall not exceed Rs.5000 each.

A. NCF divides school education into four stages.

B. It recommends the teaching of two languages till the middle stage, supplemented by a third language from the middle stage to class 10.

C. In grades 11 and 12, it is mandatory to study two languages, one of which must be Indian.

1) Both A and B

2) Only B

3) Both A and C

4) Both B and C

5) All A, B and C

Ans: 5

Solution:

Some key proposals of National Curriculum Framework.

• Like the draft, the revised NCF divides school education into four stages: Foundational (preschool to grade 2), Preparatory (grades 2 to 5), Middle (grades 6 to 8), and Secondary (grades 9 to 12).

• It recommends the teaching of two languages till the middle stage, supplemented by a third language from the middle stage to class 10. Two out of these three languages must be “native to India”.

• In the middle stage, students are expected to study, apart from the languages, mathematics, art education, physical education, science, social science, and a subject of vocational education.

• In grades 11 and 12, it is mandatory to study two languages, one of which must be Indian. In this phase, students have the freedom to choose the remaining four or five subjects from different streams — commerce, sciences, humanities — leaving ample room for interdisciplinarity. A student may pick English and Sanskrit as her languages for example, and study history, journalism, mathematics, and gardening alongside.

A. There has been increase of about 1.42 million in MI schemes during 6th MI census as compared to 5th Census.

B. Most MI schemes are under public ownership.

C. For the first time, the information about gender of the owner of MI scheme was also collected in case of individual ownership.

1) Only C

2) Both B and C

3) Both A and C

4) Only A

5) None of the above

Ans: 3

Solution:

The Ministry of Jal Shakti, Department of Water Resources, River Development and Ganga Rejuvenation today released the report on the 6th census on minor irrigation schemes. As per the report, 23.14 million minor irrigation (MI) schemes have been reported in the country, out of which 21.93 million (94.8%) are Ground Water (GW) and 1.21 million (5.2%) are Surface Water (SW) schemes. Uttar Pradesh possesses the largest number of MI schemes in the country followed by Maharashtra, Madhya Pradesh, and Tamil Nadu. Leading States in GW schemes are Uttar Pradesh, Maharashtra, Madhya Pradesh, Tamil Nadu, and Telangana. In SW schemes Maharashtra, Karnataka, Telangana, Odisha, and Jharkhand have the highest share. GW schemes comprise dug wells, shallow tube wells, medium tube wells and deep tube wells. The SW schemes comprise surface flow and surface lift schemes.

There has been increase of about 1.42 million in MI schemes during 6th MI census as compared to 5th Census.

For the first time, the information about gender of the owner of MI scheme was also collected in case of individual ownership. Out of all the individually owned schemes, 18.1% are owned by women. Around 60.2% schemes have single source of finance whereas 39.8% schemes have more than one source of finance. In single source of finance, majority of schemes (79.5%) are being financed by own savings of individual farmer.

1) Two Women SHG members, wherever applicable.

2) School Headmaster/Teacher

3) At least five MGNREGA workers from the Gram Panchayat

4) Gram Panchayat Head/Sarpanch

5) None of the above

Ans: 3

Solution:

The Payment Committee should comprise the following:

• GP Head/Sarpanch or Traditional Tribal Head (or Mukhiya in Scheduled Areas)

• GP member from the ward where the works have been executed

• Two women SHG members, (wherever applicable)

• At least three MGNREGA workers from the GP, out of whom at least one should be a woman and at least one should be from SC/ST

• School headmaster/teacher.

- Sign Up on Practicemock for Updated Current Affairs, Free Topic Tests and Free Mini Mocks

- Sign Up Here to Download Free Study Material

Free Mock Tests for the Upcoming Exams

- IBPS PO Free Mock Test

- RBI Grade B Free Mock Test

- IBPS SO Free Mock Test

- NABARD Grade A Free Mock Test

- SSC CGL Free Mock Test

- IBPS Clerk Free Mock Test

- IBPS RRB PO Free Mock Test

- IBPS RRB Clerk Free Mock Test

- RRB NTPC Free Mock Test

- SSC MTS Free Mock Test

- SSC Strenographer Free Mock Test

- GATE Mechanical Free Mock Test

- GATE Civil Free Mock Test

- RRB ALP Free Mock Test

- SSC CPO Free Mock Test

- AFCAT Free Mock Test

- SEBI Grade A Free Mock Test

- IFSCA Grade A Free Mock Test

- RRB JE Free Mock Test

- Free Banking Live Test

- Free SSC Live Test