This segment aims to finetune your preparation by asking static questions based on the topics covered in Mint newspaper. It has been observed that even static questions in Phase II (Economic and Social Issues, and Finance) of RBI Grade B and both phases of NABARD Grade A are hugely influenced by the topics in the news. On that note, please attempt the quizzes and evaluate where you stand.

RBI Grade B Free Mock Test 2023

Below we will be providing a set of 5 questions and answers on a daily basis for the aspirants to keep up their exam preparation.

Click Here for Previous Months’ Mint StatiCA

Mint StatiCA MCQs – April 26, 2023

A. All Commercial Banks need prior approval of RBI for appointment/re-appointment/termination of Chairman, Whole-time Directors, Managing Director, and CEO.

B. RBI can supersede the Board of Directors of Commercial Banks without the consultation with Central Govt.

C. RBI regulates the banks to maintain certain reserves in the form of CRR and SLR.

1) All A, B and C

2) Both A and B

3) Both B and C

4) Only B

5) Only C

Ans: 5

Solution:

RBI issues various guidelines for directors of banks and also has powers to appoint additional directors on the board of a banking company. Commercial Banks (except PSBs) need prior approval of RBI for appointment/re-appointment/termination of Chairman, Whole-time Directors, Managing Director and CEO. RBI can appoint additional directors in commercial banks (except PSBs). RBI in consultation with Central Govt., can supersede the Board of Directors of Commercial Banks. Public Sector Banks (PSBs) are under dual regulation of Central Govt. and RBI. RBI’s powers are curtailed regarding PSBs, where RBI cannot remove directors and management, cannot supersede banks board and does not have the power to force a merger or trigger liquidation.RBI regulates the banks to maintain certain reserves in the form of CRR and SLR

Identify A.

1) 10,000

2) 11,000

3) 12,000

4) 13,000

5) None of the Above

Ans: 4

Solution:

The government had set a target of 13,000 km of highway construction in FY2022-23, but the speed of construction was affected by unfavorable weather conditions. The road ministry is likely to complete the construction of 11,000 km of national highways in the current financial year.

A. AIF does not include funds covered under the SEBI (Mutual Funds) Regulations, 1996, SEBI (Collective Investment Schemes) Regulations, 1999 or any other regulations of the Board to regulate fund management activities.

B. AIFs which employ diverse or complex trading strategies and may employ leverage including through investment in listed or unlisted derivatives are under Category II AIF.

C. “Angel fund” is a sub-category of Venture Capital Fund under Category II Alternative Investment Fund that raises funds from angel investors.

1) All A, B and C

2) Only C

3) Both A and B

4) Only A

5) None of the Above

Ans: 4

Solution:

Alternative Investment Fund or AIF means any fund established or incorporated in India which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors. AIF does not include funds covered under the SEBI (Mutual Funds) Regulations, 1996, SEBI (Collective Investment Schemes) Regulations, 1999 or any other regulations of the Board to regulate fund management activities. Further, certain exemptions from registration are provided under the AIF Regulations to family trusts set up for the benefit of ‘relatives‘ as defined under Companies Act, 1956, employee welfare trusts or gratuity trusts set up for the benefit of employees, ‘holding companies‘ within the meaning of Section 4 of the Companies Act, 1956 etc.

Category III AIFs which employ diverse or complex trading strategies and may employ leverage including through investment in listed or unlisted derivatives.

“Angel fund” is a sub-category of Venture Capital Fund under Category I Alternative Investment Fund that raises funds from angel investors and invests in accordance with the provisions of Chapter III-A of AIF Regulations.

A. Vibrant Village Program provides comprehensive development of villages on the border with China and Bangladesh for the improvement in the quality of life of people living in identified border villages.

B. Under this programme, the development work of villages will be done at 3 levels.

C. Minister of Cooperation Shri Amit Shah launched the ‘Vibrant Villages Programme’ at Kibithoo – a border village in Sikkim.

1) Only B

2) All A, B and C

3) Only C

4) Both A and C

5) None of the above

Ans: 1

Solution:

Recently, Union Home Minister Amit Shah was in Arunachal Pradesh for the launch of the ‘Vibrant Villages Programme’ (VVP) in the border village of Kibithoo. The constant threat along the country’s border amid the ongoing standoff with China has led to a concerted push to upgrade infrastructure in the border areas. To this end, the Union Cabinet on February 15 approved the allocation of Rs 4,800 crore for the Centre’s ‘Vibrant Villages Programme.

A. The insurance charges shall not be included in the computation of Annual Percentage Rate.

B. Reasonable one-time processing fee can be retained if the customer exits the loan during cooling-off period.

C. All Lending Service Providers would need to appoint a nodal Grievance Redressal Officer.

1) Only B

2) All A, B and C

3) Both A and C

4) Only A

5) None of the above

Ans: 1

Solution:

The insurance charges shall be included in the computation of APR only for the insurance which is linked/integrated in loan products as these charges are intrinsic to the nature of such digital loans.

The principle underlying the Digital Lending Guidelines is that a LSP should not be involved in handling of funds flowing from the lender to the borrower or vice versa. While entities offering only PA services shall remain out of the ambit of ‘Guidelines on Digital Lending’, any PA also performing the role of an LSP must comply with the Digital Lending Guidelines.

Reasonable one-time processing fee can be retained if the customer exits the loan during cooling-off period. This, if applicable, should be disclosed to the customer upfront in KFS. However, the processing fee has to be mandatorily included for the computation of APR.

Only those LSPs which have an interface with the borrowers would need to appoint a nodal Grievance Redressal Officer. However, it may be reiterated that the RE shall remain responsible for ensuring resolution of complaints arising out of actions of all LSPs engaged by them.

Mint StatiCA MCQs – April 25, 2023

A. It is a single-window, independent, nodal agency that functions as an autonomous agency under the Prime Minister’s Office.

B. The agency acts as an interface between ISRO and Non-Governmental Entities (NGEs) and assesses how to utilize India’s space resources better and increase space-based activities.

C. It is formed to commercial exploit the global space market using ISRO Facilities. It also acts as the commercial arm of ISRO.

1) All A, B and C

2) Both A and B

3) Both B and C

4) Only A

5) Only B

Ans: 5

Solution:

Indian National Space Promotion and Authorisation Centre (IN-SPACe) is a single-window, independent, nodal agency that functions as an autonomous agency in the Department of Space (DOS). It is formed following the Space sector reforms to enable and facilitate the participation of private players.

IN-SPACe is responsible to promote, enable authorize and supervise various space activities of non-governmental entities including building launch vehicles & satellites and providing space-based services; sharing space infrastructure and premises under the control of DOS/ISRO; and establishing of new space infrastructure and facilities.

The agency acts as an interface between ISRO and Non-Governmental Entities (NGEs) and assesses how to utilize India’s space resources better and increase space-based activities. It also assesses the needs and demands of private players, including educational and research institutions, and explores ways to accommodate these requirements in consultation with ISRO.

Antrix Corporation Limited (Antrix), incorporated on 28 September 1992 (under the Companies Act, 1956), is a wholly owned Government of India Company under the administrative control of Department of Space (DOS). Antrix is the commercial arm of Indian Space Research Organisation (ISRO).

Identify A.

1) Rs 3 Lakhs

2) Rs 4 Lakhs

3) Rs 5 Lakhs

4) Rs 6 Lakhs

5) Rs 3.5 Lakhs

Ans: 3

Solution:

In her first announcement regarding rebate, she proposed to increase the rebate limit to Rs.7 lakh in the new tax regime, which would mean that the persons in the new tax regime, with income up to Rs. 7 lakh will not have to pay any tax. Currently, those with income up to Rs. 5 lakh do not pay any income tax in both old and new tax regimes.

Providing relief to middle-class individuals, she proposed a change in the tax structure in the new personal income tax regime by reducing the number of slabs to five and increasing the tax exemption limit to Rs. 3 lakh.

1) Berubari Union Case

2) AK Gopalan Case

3) Maneka Gandhi Case

4) AK Gopalan Case

5) None of the Above

Ans: 5

Solution:

It may be noted that the Kesavananda Bharati case is also known as the Fundamental Rights and Basic Structure case wherein the Apex Court, in a 7-6 decision, asserted its right to strike down amendments to the Constitution that were in violation of the fundamental architecture of the Constitution.

Identify A.

1) 2014

2) 2015

3) 2016

4) 2017

5) None of the above

Ans: 3

Solution:

The Insolvency and Bankruptcy Code, 2016 (IBC) is an Indian law which creates a consolidated framework that governs insolvency and bankruptcy proceedings for companies, partnership firms, and individuals.

A. India remains the biggest arms importer between 2018-22 with increase in overall imports as well.

B. Russia was the largest supplier of arms to India, but its share of total Indian arms imports fell from 64% to 35%.

C. The U.S. share of global arms exports increased from 33% to 40% while Russia’s fell from 22% to 16%.

1) Only A

2) Only B

3) Only C

4) Both A and B

5) Both B and C

Ans: 3

Solution:

India is the world’s largest arms importer for the period between 2018-22, according to Stockholm International Peace Research Institute (SIPRI) despite a drop in overall imports.

Russia was the largest supplier of arms to India, but its share of total Indian arms imports fell from 64% to 45%.

The U.S. share of global arms exports increased from 33% to 40% while Russia’s fell from 22% to 16%.

Mint StatiCA MCQs – April 24, 2023

A. Intra-group sales are excluded from the total turnover while computing threshold limit under Section 5 of the Act. The purpose of exclusion of intra-group turnover is to avoid double counting.

B. The Act does not specifically define merger or amalgamation.

C. Acquisition of up to 25% shares where the acquirer does not acquire control and the acquisition is solely as an investment or in ordinary course of business, need not normally be notified to the CCI for prior approval.

1) All A, B and C

2) Both A and B

3) Both B and C

4) Only A

5) Only B

Ans: 1

Solution:

Intra-group sales are excluded from the total turnover while computing threshold limit under Section 5 of the Act. The purpose of exclusion of intra-group turnover is to avoid double counting. However, when an overseas group entity makes further supply (supplied to it under intra-group export) outside India, the turnover relating to such subsequent sale is not counted as turnover in India. If one were to also exclude Intra Group Export Turnover, the economic value addition generated from India goes unaccounted for.

The Act does not specifically define merger or amalgamation. Merger is largely understood to mean where assets and liabilities of an entity are transferred to another entity and the first entity loses its existence. Amalgamation is largely understood to mean where two or more existing entities merge to form a new entity and existing entities lose their existence.

Acquisition of up to 25% shares where the acquirer does not acquire control and the acquisition is solely as an investment or in ordinary course of business, need not normally be notified to the CCI for prior approval. The acquisition of less than 10% of the total shares or voting rights of an enterprise shall be treated as solely as an investment. Provided that in relation to the said acquisition,-the Acquirer has ability to exercise only such rights that are exercisable by the ordinary shareholders of the target enterprise the extent of their respective shareholding; and the Acquirer is not a member of the board of directors of the target enterprise and does not have a right or intention to nominate a director on the board of directors of the such enterprise and does not intend to participate in the affairs or management of the such enterprise.

Identify A and B.

1) 2025, 90%

2) 2024, 100%

3) 2025, 100%

4) 2023, 90%

5) None of the Above

Ans: 2

Solution:

Jal Jeevan Mission is envisioned to provide safe and adequate drinking water through individual household tap connections by 2024 to all households in rural India. The programme will also implement source sustainability measures as mandatory elements, such as recharge and reuse through grey water management, water conservation, rainwater harvesting.

1) Ministry of Rural Development

2) Ministry of Social Justice and Empowerment

3) Ministry of Statistics and Programme Implementation

4) Both 1 and 2

5) None of the Above

Ans: 3

Solution:

The basic objective of the 20-Point Programme is to eradicate poverty and to improve the quality of life of the poor and the under privileged population of the country. The programme covers various Socio-economic aspects like poverty, employment, education, housing, health, agriculture and land reforms, irrigation, drinking water, protection and empowerment of weaker sections, consumer protection, environment etc.

The monitoring of the programme at the centre has been assigned to the Ministry of Statistics and Programme Implementation, Government of India. The management information system relating to Twenty Point developed by the Ministry consists of a monthly Progress Report (MPR) and yearly Review of the Programme, Pointwise, Item-wise and State-wise. The monthly report covers progress on the implementation of the programme for 20 crucial points for which there is pre-set physical targets and the Yearly Review presents an analytical review of the performance of all the items under the programme.

A. An Oligopoly market situation is also called ‘competition of many’.

B. Telecom Operators like Airtel, Jio are under Oligopoly market.

C. Seller influences the behaviour of the other firms and other firms influence it.

1) Both A and B

2) All A, B and C

3) Only C

4) Both B and C

5) None of the above

Ans: 4

Solution:

Oligopoly is the market where there are few firms. Thus, it is known as the ‘Competition among few’. Also, as there are few sellers in the market, every seller influences the behaviour of the other firms and other firms influence it.

Identify A.

1) Rs 2 Lakhs

2) Rs 3 Lakhs

3) Rs 4 Lakhs

4) Rs 5 Lakhs

5) None of the above

Ans: 1

Solution:

Individuals investing up to Rs. 2 lakhs in an IPO are categorized by the SEBI as retail investors. Such investors are usually small-time individuals with low net worth and without the backing of large corporations.

Mint StatiCA MCQs – April 21, 2023

A. The Union Cabinet approved the National Quantum Mission (NQM) at a total cost of Rs.6003.65 crore from 2023-24 to 2030-31, aiming to seed, nurture and scale up scientific and industrial R&D.

B. The new mission targets developing intermediate-scale quantum computers with 50-1000 physical qubits in 8 years in various platforms like superconducting and photonic technology.

C. Five Thematic Hubs (T-Hubs) will be set up in top academic and National R&D institutes.

1) Only A

2) All A, B and C

3) Both A and B

4) Only C

5) Both B and C

Ans: 3

Solution:

The Union Cabinet, chaired by the Hon’ble Prime Minister Shri Narendra Modi, today approved the National Quantum Mission (NQM) at a total cost of Rs.6003.65 crore from 2023-24 to 2030-31, aiming to seed, nurture and scale up scientific and industrial R&D and create a vibrant & innovative ecosystem in Quantum Technology (QT). This will accelerate QT-led economic growth, nurture the ecosystem in the country and make India one of the leading nations in the development of Quantum Technologies & Applications (QTA).

The new mission targets developing intermediate-scale quantum computers with 50-1000 physical qubits in 8 years in various platforms like superconducting and photonic technology. Satellite-based secure quantum communications between ground stations over a range of 2000 kilometers within India, long-distance secure quantum communications with other countries, inter-city quantum key distribution over 2000 km as well as multi-node Quantum networks with quantum memories are also some of the deliverables of the Mission.

The mission will help develop magnetometers with high sensitivity in atomic systems and Atomic Clocks for precision timing, communications, and navigation. It will also support the design and synthesis of quantum materials such as superconductors, novel semiconductor structures, and topological materials for the fabrication of quantum devices. Single photon sources/detectors, and entangled photon sources will also be developed for quantum communications, sensing, and metrological applications.

Four Thematic Hubs (T-Hubs) will be set up in top academic and National R&D institutes in the domains – Quantum Computing, Quantum Communication, Quantum Sensing & Metrology, and Quantum Materials & Devices. The hubs will focus on the generation of new knowledge through basic and applied research as well as promote R&D in areas that are mandated to them.

NQM can take the technology development ecosystem in the country to a globally competitive level. The mission would greatly benefit communication, health, financial and energy sectors as well as drug design, and space applications. It will provide a huge boost to National priorities like digital India, Make in India, Skill India and Stand-up India, Start-up India, Self-reliant India, and Sustainable Development Goals (SDG).

Identify A.

1) 1988

2) 1989

3) 1990

4) 1991

5) 1992

Ans: 1

Solution:

The Securities and Exchange Board of India was constituted as a non-statutory body on April 12, 1988 through a resolution of the Government of India. The Securities and Exchange Board of India was established as a statutory body in the year 1992 and the provisions of the Securities and Exchange Board of India Act, 1992 (15 of 1992) came into force on January 30, 1992.

Identify A and B.

1) 15 crores, 5 crores

2) 10 crores, 2 crores

3) 12 crores, 3 crores

4) 15 crores, 4 crores

5) None of the above

Ans: 2

Solution:

“Anchor Investor” means a qualified institutional buyer who makes an application for a value of at least ten crore rupees in a public issue on the main board made through the book building process in accordance with these regulations or makes an application for a value of at least two crore rupees for an issue made in accordance with the SEBI Regulations.

A. Nuclear power generation is excluded under this initiative.

B. “Green Finance Working Committee” will meet at least twice a year to support Ministry of Finance with selection and evaluation of projects and other relevant work related to the Framework.

C. The proceeds will be deposited to the Consolidated Fund of India (CFI) in line with the regular treasury policy, and then funds from the CFI will be made available for eligible green projects.

1) Only C

2) All A, B and C

3) Both A and B

4) Both A and C

5) None of the above

Ans: 2

Solution:

Excluded Projects are • Projects involving new or existing extraction, production and distribution of fossil fuels, including improvements and upgrades; or where the core energy source is fossil-fuel based • Nuclear power generation • Direct waste incineration • Alcohol, weapons, tobacco, gaming, or palm oil industries • Renewable energy projects generating energy from biomass using feedstock originating from protected areas • Landfill projects • Hydropower plants larger than 25 MW.

Ministry of Finance has constituted a “Green Finance Working Committee” (GFWC) with representation from relevant line ministries and chaired by Chief Economic Adviser, Government of India. GFWC will meet at least twice a year to support Ministry of Finance with selection and evaluation of projects and other relevant work related to the Framework. Initial evaluation of the project will be the responsibility of the concerned Ministry/Department in consultation with experts.

The proceeds will be deposited to the Consolidated Fund of India (CFI) in line with the regular treasury policy, and then funds from the CFI will be made available for eligible green projects. For the purposes of ensuring that the proceeds’ allocation and accounting is transparent, clear and beyond doubt, a separate account will be created and maintained by the Ministry of Finance Government of India

Identify A.

1) 39.27

2) 40.27

3) 41.27

4) 38.27

5) None of the above

Ans: 2

Solution:

The Eight Core Industries comprise 40.27 percent of the weight of items included in the Index of Industrial Production (IIP).

Mint StatiCA MCQs – April 20, 2023

Which of the following statements is/are correct about SEBI?

A. SEBI is a statutory body established on April 12, 1992 in accordance with the provisions of the Securities and Exchange Board of India Act, 1992.

B. Before SEBI came into existence, Controller of Capital Issues was the regulatory authority; it derived authority from the Capital Issues (Control) Act, 1947.

C. The headquarters of SEBI is situated in Mumbai. The regional offices of SEBI are located in Bhopal, Kolkata, Chennai, and Delhi.

(1) Only A and B

(2) Only B and C

(3) Only A and C

(4) Only B

(5) A, B, and C

Ans: 1

Solution:

SEBI is a statutory body established on April 12, 1992, in accordance with the provisions of the Securities and Exchange Board of India Act, 1992.

Before SEBI came into existence, the Controller of Capital Issues was the regulatory authority; it derived authority from the Capital Issues (Control) Act, of 1947.

The headquarters of SEBI is situated in Mumbai. The regional offices of SEBI are located in Ahmedabad, Kolkata, Chennai, and Delhi.

A. It aims to improve the operational efficiencies and financial sustainability of discoms (excluding Private Sector DISCOMs).

B. 60 % of the outlay is for better feeder and transformer metering and pre-paid smart consumer metering.

C. Rural Electrification Corporation and Power Finance Corporation are the nodal agencies for the implementation of this programme.

(1) Only A and B

(2) Only B and C

(3) Only A and C

(4) Only B

(5) A, B and C

Ans: 3

Solution:

Revamped Distribution Sector Reform Scheme (RDSS)

It aims to improve the operational efficiencies and financial sustainability of discoms (excluding Private Sector DISCOMs).

It will provide conditional financial assistance to strengthen the supply infrastructure of discoms.

Half of the outlay is for better feeder and transformer metering and pre-paid smart consumer metering. The remaining half, 60% of which will be funded by central government grants, will be spent on power loss reduction and strengthening networks.

It is an umbrella programme merging all the existing power sector reforms schemes – Integrated Power Development Scheme, DDU Gram Jyoti Yojana, and Pradhan Mantri Sahaj Bijli Har Ghar Yojana will be merged into this umbrella program.

Rural Electrification Corporation and Power Finance Corporation are the nodal agencies for the implementation of this programme.

Identify the incorrect statement(s) about the MPC.

A. Under Section 45ZB of the amended (in 2016) RBI Act, 1934, the central government is empowered to constitute a four-member Monetary Policy Committee (MPC).

B. The primary objective of the RBI’s monetary policy is to maintain price stability while keeping in mind the objective of growth.

C. Section 45ZB lays down that “the Monetary Policy Committee shall determine the Policy Rate required to achieve the inflation target”.

(1) Only A and B

(2) Only B and C

(3) Only A and C

(4) Only A

(5) A, B and C

Ans: 4

Solution:

Monetary policy refers to the policy of the central bank with regard to the use of monetary instruments under its control to achieve the goals specified in the Act.

The primary objective of the RBI’s monetary policy is to maintain price stability while keeping in mind the objective of growth.

Price stability is a necessary precondition to sustainable growth.

The amended RBI Act, 1934 also provides for the inflation target (4% +-2%) to be set by the Government of India, in consultation with the Reserve Bank, once in every five years.

Under Section 45ZB of the amended (in 2016) RBI Act, 1934, the central government is empowered to constitute a six-member Monetary Policy Committee (MPC).

Objective: Further, Section 45ZB lays down that “the Monetary Policy Committee shall determine the Policy Rate required to achieve the inflation target”.

The decision of the Monetary Policy Committee shall be binding on the Bank.

Identify ‘C’ in CBAM.

(1) Continental

(2) Cross

(3) Country

(4) Carbon

(5) None of these

Ans: 4

Solution:

Starting 1 October, iron, steel and aluminum exports to the European Union from across the world will face added scrutiny after the European Parliament earlier this week passed the Carbon Border Adjustment Mechanism (CBAM).

Identify (A) in the above excerpt.

(1) 2013

(2) 2015

(3) 2017

(4) 2019

Ans: 2

Solution:

FAME India is a part of the National Electric Mobility Mission Plan. The main thrust of FAME is to encourage electric vehicles by providing subsidies.

The FAME India Scheme is aimed at incentivizing all vehicle segments.

Phase I: started in 2015 and was completed on 31st March, 2019

The scheme covers Hybrid & Electric technologies like Mild Hybrid, Strong Hybrid, Plug in Hybrid & Battery Electric Vehicles.

Monitoring Authority: Department of Heavy Industries, the Ministry of Heavy Industries and Public Enterprises.

Fame India Scheme has four focus Areas:

-Technology development

-Demand Creation

-Pilot Projects

-Charging Infrastructure

Mint StatiCA MCQs – April 19, 2023

Identify A and B.

1) Reliance Industries, Maharashtra

2) Tata, Maharashtra

3) Vedanta, Gujarat

4) JSW, Noida

5) None of the above

Ans: 3

Solution:

Vedanta-Foxconn Semiconductors, the joint venture between India’s Vedanta group and Taiwanese contract manufacturer Foxconn, aims to begin generating revenue from its semiconductor fabrication unit in India from FY27. Vedanta-Foxconn JV finalises Gujarat’s Dholera for India’s first semiconductor plant.

1) Married couples with at least 1 year of stable marital relationship

2) A single female can adopt a child of any gender.

3) A single male is not eligible to adopt a girl child.

4) Prospective Parents from any religion are eligible to adopt a child under Juvenile Justice Act(C&PC), 2015.

5) All are correct

Ans: 1

Solution:

Prospective adoptive parents (PAP): – who are physically, mentally, and emotionally stable, financially capable and who do not have any life-threatening medical conditions are eligible to adopt. The minimum age difference between the child and PAP/s shall not be less than twenty-five years.

Married couples with at least 2 years of stable marital relationship. Both spouses must consent for adoption in case of a married couple. The composite age of the married couple does not exceed 110 years.

A single female can adopt a child of any gender. A single male is not eligible to adopt a girl child. Age of a single parent does not exceed 55 years. Must have less than four children unless they are adopting a child with special needs, a hard to-place child, a relative’s child, or a stepchild.

Identify A.

1) 75%

2) 85%

3) 90%

4) 80%

5) 70%

Ans: 3

Solution:

Every scheduled bank, small finance bank and payments bank shall maintain minimum CRR of not less than ninety per cent of the required CRR on all days during the reporting fortnight, in such a manner that the average of CRR maintained daily shall not be less than the CRR prescribed by the Reserve Bank.

A. An average annual turnover of more than Rs. 20,000 crores during the last three years.

B. An average annual net profit of more than Rs. 2,500 crores during the last 2 years.

C. Listed on the Indian stock exchange, with a minimum prescribed public shareholding under SEBI regulations.

1) Both A and B

2) All A, B and C

3) Only C

4) Both A and C

5) None of the above

Ans: 4

Solution:

CPSEs fulfilling the following criteria are eligible to be considered for grant of Maharatna status:

Having Navratna status.

Listed on the Indian stock exchange, with a minimum prescribed public shareholding under SEBI regulations.

An average annual turnover of more than Rs. 20,000 crores during the last three years.

An average annual net worth of more than Rs.10,000 crores during the last three years.

An average annual net profit of more than Rs. 2,500 crores during the last 3 years.

Significant global presence or international operations.

A. PAN stands for Permanent Account Number. PAN is a twelve-digit unique alphanumeric number issued by the Income Tax Department.

B. PAN enables the department to link all transactions of the assessee with the department.

C. The applicant must pay a fee of Rs. 93 + GST as applicable, per PAN application.

1) Both B and C

2) All A, B and C

3) Both A and B

4) Only B

5) Only C

Ans: 1

Solution:

PAN stands for Permanent Account Number. PAN is a ten-digit unique alphanumeric number issued by the Income Tax Department. PAN is issued in the form of a laminated plastic card (commonly known as PAN card).

PAN enables the department to link all transactions of the assessee with the department. These transactions include tax payments, TDS/TCS credits, returns of income, specified transactions, correspondence and so on. It facilitates easy retrieval of information of assessee and matching of various investments, borrowings, and other business activities of assessee.

A Permanent Account Number has been made compulsory for every transaction with the Income-tax Department. It is also mandatory for numerous other financial transactions such as opening of bank accounts, in bank account, deposit of cash in bank account, opening of Demat account, transaction of immovable properties, dealing in securities, etc. A PAN card is a valuable means of photo identification accepted by all Government and non-Government institutions in the country.

The applicant must pay a fee of Rs. 93 + GST as applicable, per PAN application. In case, the PAN card is to be dispatched outside India then the fee for processing PAN application is Rs. 864 (Rs. 93 application fees and Rs. 771 dispatch charges)/- will have to be paid by applicant. (plus GST as applicable).

Mint StatiCA MCQs – April 18, 2023

A. In the revised WPI basket, the number of items has been increased from 676 to 697.

B. WPI basket the weight of Primary Articles group has increased from 20.1 per cent to 22.6 per cent, whereas the weight of Fuel and Power group has declined from 14.9 per cent to 13.2 per cent.

C. The current revision of WPI is based on the recommendations of Working Group constituted under the chairmanship of Late Dr. Saumitra Chaudhuri.

1) Only A

2) All A, B and C

3) Both B and C

4) Only B

5) Only C

Ans: 2

Solution:

The current revision is the seventh since its regular introduction. The current revision of WPI is based on the recommendations of Working Group constituted under the chairmanship of Late Dr. Saumitra Chaudhuri, Ex Member, erstwhile Planning Commission which submitted its report in March 2014.

In the new WPI series significant improvement in concept, coverage and methodology has been made. In the revised WPI basket, the number of items has been increased from 676 to 697. Efforts have been made to 5 enhance the number of quotations from 5482 to 8331. The increase in number of quotations has been done across the major groups to ensure comprehensive coverage and representativeness. New definition of wholesale price index does not include taxes to remove impact of fiscal policy.

Identify A and B.

1) 2016, Varun

2) 2015, Tarun

3) 2017, Tarun

4) 2018, Varun

5) None of the Above.

Ans: 5

Solution:

MUDRA, which stands for Micro Units Development & Refinance Agency Ltd., is a financial institution set up by Government of India for development and refinancing of micro units enterprises. It was announced by the Hon’ble Finance Minister while presenting the Union Budget for FY 2016. The purpose of MUDRA is to provide funding to the non-corporate small business sector through various Last Mile Financial Institutions like Banks, NBFCs and MFIs.

Under the aegis of Pradhan Mantri MUDRA Yojana (PMMY), MUDRA has already created its initial products / schemes. The interventions have been named ‘Shishu’, ‘Kishor’ and ‘Tarun’ to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also to provide a reference point for the next phase of graduation / growth to look forward to. The financial limit for these schemes are:-

Shishu : covering loans upto 50,000/-

Kishor : covering loans above 50,000/- and upto 5 lakh

Tarun : covering loans above 5 lakh to 10 lakh

A. Joint Holding is not allowed under this scheme.

B. Minimum investment in the Bond shall be one gram with a maximum limit of subscription of 4 kg for individuals, 4 kg for Hindu Undivided Family (HUF) and 20 kg for trusts.

C. The Bonds bear interest at the rate of 1.50 per cent (fixed rate) per annum on the amount of initial investment.

1) Only B

2) Both B and C

3) Only A

4) All A, B and C

5) Both A and C

Ans: 5

Solution:

SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors must pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of Government of India. Joint holding is allowed. The Bonds are issued in denominations of one gram of gold and in multiples thereof. Minimum investment in the Bond shall be one gram with a maximum limit of subscription of 4 kg for individuals, 4 kg for Hindu Undivided Family (HUF) and 20 kg for trusts and similar entities notified by the government from time to time per fiscal year (April – March). The Bonds bear interest at the rate of 2.50 per cent (fixed rate) per annum on the amount of initial investment. Interest will be credited semi-annually to the bank account of the investor and the last interest will be payable on maturity along with the principal.

1) SEBI

2) RBI

3) SBI

4) Bank Bureau of India

5) None of the above

Ans: 2

Solution:

Credit bureaus in India are regulated by the Reserve Bank of India (RBI). The RBI has established guidelines for the operation of credit bureaus, including the types of information that can be included in credit reports and the ways in which this information can be used.

Whereas Credit Rating Agencies are regulated by the SEBI.

Identify A and B.

1) Ujjiwan, 2017

2) Ujala, 2016

3) Ujwal, 2015

4) Ujala, 2017

5) None of the above

Ans: 3

Solution:

Ministry of Power, GoI launched Ujwal DISCOM Assurance Yojana (UDAY) which was approved by Union Cabinet on 5th November, 2015.

The scheme envisages:

Financial Turnaround

Operational improvement

Reduction of cost of generation of power

Development of Renewable Energy

Energy efficiency & conservation

Mint StatiCA MCQs – April 17, 2023

Which of the following statements are correct about the World Happiness Report?

A. 20th March is observed annually as the International Day of Happiness.

B. The World Happiness Report is a publication of the UN Sustainable Development Solutions Network.

C. India ranks at 126th position out of 136 countries, making it one of the least happy countries in the world.

1) Only A

2) All A, B, and C

3) Both B and C

4) Only B

5) Only CAns: 2

Solution: The World Happiness Report is a publication of the Sustainable Development Solutions Network, powered by the Gallup World Poll data. The World Happiness Report reflects a worldwide demand for more attention to happiness and well-being as criteria for government policy. It reviews the state of happiness in the world today and shows how the science of happiness explains personal and national variations in happiness.

Since 2013, the United Nations has celebrated 20th March every year to recognize the importance of happiness in the lives of people around the world.

In a recent report, Finland has been crowned as the happiest nation, Denmark is at number two, followed by Iceland at number three.

India ranks at 126th position out of 136 countries, making it one of the least happy countries in the world.Prime Minister Shri Narendra Modi today launched the Gati Shakti – National Master Plan for Multi-modal Connectivity in New Delhi, heralding a new chapter in governance. Gati Shakti — a digital platform — will bring _(A)_____Ministries including Railways and Roadways together for integrated planning and coordinated implementation of infrastructure connectivity projects.

Identify A.

1) 12

2) 13

3) 14

4) 15

5) 16Ans: 5

Solution:

Prime Minister Shri Narendra Modi launched the Gati Shakti – National Master Plan for Multi-modal Connectivity in New Delhi, heralding a new chapter in governance. Gati Shakti — a digital platform — will bring 16 Ministries including Railways and Roadways together for integrated planning and coordinated implementation of infrastructure connectivity projects.

It will incorporate the infrastructure schemes of various Ministries and State Governments like Bharatmala, Sagarmala, inland waterways, dry/land ports, UDAN etc. Economic Zones like textile clusters, pharmaceutical clusters, defence corridors, electronic parks, industrial corridors, fishing clusters, agri zones will be covered to improve connectivity & make Indian businesses more competitive. It will also leverage technology extensively including spatial planning tools with ISRO imagery developed by BiSAG-N (Bhaskaracharya National Institute for Space Applications and Geoinformatics).Which of the following committee paved the way for Implementing the National Health Stack?

1) Shri J. Satyanarayana Committee

2) Shri Sai Mukherjee Committee

3) Shri Kartar Singh Committee

4) Shri Bhore Committee

5) None of the AboveAns: 1

Solution:

Ministry of Health and Family Welfare constituted a committee headed by Shri J. Satyanarayana to develop an implementation framework for the National Health Stack. This committee produced the National Digital Health Blueprint (NDHB), laying out the building blocks and an action plan to implement digital health comprehensively and holistically.For the FY 2022-23, (A) has emerged as the biggest trading partner. With whom India has Trade (B).

Identify A and B.

1) China, Deficit

2) USA, Surplus

3) China, Surplus

4) UAE, Surplus

5) None of the aboveAns: 2

Solution:

The USA is one of the few countries with which India has a trade surplus. In 2022-23, India had a trade surplus of $28 billion with the US. In 2022-23, the UAE was the third largest trading partner of India, it was followed by Saudi Arabia and Singapore.Which of the following statements are correct about the response of RBI and Government post 2008 Financial crisis that shook the financial markets worldwide?

A. The central government launched two fiscal packages in December 2008 and January 2009 and these fiscal stimulus packages amounting to about 6% of GDP.

B. RBI increased during late 2008 till 2009 to tackle the spill over effects of financial shock.

C. RBI followed Regulatory Forbearance post crisis to ease the economy.

1) Both A and C

2) Both A and B

3) Only C

4) All A, B and C

5) Both B and CAns: 3

Solution:

The central government launched two fiscal packages in December 2008 and January 2009. These fiscal stimulus packages amounting to about 3% of GDP.

RBI decreased Reserve Repo Rate, Repo Rate, Cash Reserve Ratio and Statutory Liquidity Ratio during late 2008 till 2009 to tackle the spill over effects of financial shock from the global markets. RBI wanted to maintain comfortable rupee liquidity, to augment forex liquidity and to arrest growth in moderation.

The RBI adopted Regulatory Forbearance in 2008 in the aftermath of 2008 Global Financial Crisis.

Mint StatiCA MCQs – April 14, 2023

Which of the following statements are correct about Participatory Notes (P-Notes)?

A. These financial instruments required by investors or hedge funds to invest in Indian securities.

B. These Instruments need to be registered with the Securities and Exchange Board of India (SEBI).

C. Investment in the Indian capital markets through participatory notes dropped to ₹88,398 crore month-on-month in February 2023 amid higher valuation of domestic markets.

1) All A, B and C

2) Only A

3) Only B

4) Both B and C

5) Both A and CAns: 5

Participatory notes are financial instruments required by investors or hedge funds to invest in Indian securities without having to register with the Securities and Exchange Board of India (SEBI).

Investment in the Indian capital markets through participatory notes dropped to ₹88,398 crore month-on-month in February amid higher valuation of domestic markets. This was the third consecutive monthly decline in the investment level. Before this, investment through the route had been on an increasing trend since July 2022 because of a slump in the oil and other commodities prices.India has signed (A)__Regional Trade Agreements (RTAs)/Free Trade Agreements (FTAs) with various countries/regions namely, Japan, South Korea, countries of ASEAN region and countries of South Asian Association for Regional Cooperation (SAARC)Mauritius, United Arab Emirates, Australia. India’s merchandise exports to all these countries/regions have registered a growth in last ten years. Out of which, with FTA of (B)__, India had highest exports in 2021.

Identify A and B.

1) 11, Japan

2) 12, ASEAN

3) 13, Japan

4) 12, Japan

5) 13, ASEANAns: 5

Solution:

India has signed 13 Regional Trade Agreements (RTAs)/Free Trade Agreements (FTAs) with various countries/regions namely, Japan, South Korea, countries of ASEAN region and countries of South Asian Association for Regional Cooperation (SAARC)Mauritius, United Arab Emirates, Australia. India’s merchandise exports to all these countries/regions have registered a growth in last ten years.Which of the following statements are correct about Soil Health Card (SHC)?

A. The State Government will refer 1% of all the samples in a year to a ‘Referral Laboratory’ to analyze and certify on the results of Primary Laboratory.

B. It is a Government of India’s scheme promoted by the Department of Agriculture & Co-operation under the Ministry of Agriculture.

C. It will be made available once in a cycle of 3 years, which will indicate the status of soil health of a farmer’s holding for that particular period. The SHC given in the next cycle of 3 years will be able to record the changes in the soil health for that subsequent period.

1) Only C

2) Only A

3) Both A and B

4) All A, B, and C

5) Only BAns: 4

Solution:

It is a Government of India scheme promoted by the Department of Agriculture & Co-operation under the Ministry of Agriculture. It will be implemented through the Department of Agriculture of all the State and Union Territory Governments. An SHC is meant to give each farmer the soil nutrient status of his holding and advise him on the dosage of fertilizers and also the needed soil amendments, that he should apply to maintain soil health in the long run.

SHC is a printed report that a farmer will be handed over for each of his holdings. It will contain the status of his soil with respect to 12 parameters, namely N, P, K (Macro-nutrients) ; S (Secondary- nutrient) ; Zn, Fe, Cu, Mn, Bo (Micronutrients) ; and pH, EC, OC (Physical parameters). Based on this, the SHC will also indicate fertilizer recommendations and soil amendments required for the farm.

It will be made available once in a cycle of 3 years, which will indicate the status of soil health of a farmer’s holding for that period. The SHC given in the next cycle of 3 years will be able to record the changes in the soil health for that subsequent period.

The State Government will refer 1% of all the samples in a year to a ‘Referral Laboratory’ to analyze and certify on the results of Primary Laboratory. The State Government will be supported to establish ‘Referral Laboratories as required.Under the Startup India Action Plan, startups Turnover should be less than INR (A) in any of the previous financial years. An entity shall be considered as a startup up to (B)_ from the date of its incorporation.

Identify A and B.

1) 200 crores, 15 years

2) 100 crores, 10 years

3) 150 crores, 15 years

4) 200 crores, 10 years

5) 100 crores, 15 yearsAns: 2

Solution:

Under the Startup India Action Plan, startups that meet the definition as prescribed under G.S.R. notification 127 (E) are eligible to apply for recognition under the program. The Startups must provide support documents, at the time of application.

Eligibility Criteria for Startup Recognition:

The Startup should be incorporated as a private limited company or registered as a partnership firm or a limited liability partnership.

Turnover should be less than INR 100 Crores in any of the previous financial years.

An entity shall be considered a startup up to 10 years from the date of its incorporation.

The Startup should be working towards innovation/ improvement of existing products, services, and processes and should have the potential to generate employment/ create wealth. An entity formed by splitting up or reconstruction of an existing business shall not be considered a “Startup”.In 2020, the central government introduced the Production Linked Incentive (PLI) scheme for (A) sectors with a total incentive outlay of Rs (B).

Identity A and B.

1) 13, 1.77 Lakh crores

2) 12, 1.77 Lakh crores

3) 14, 1.97 Lakh crores

4) 13, 1.87 Lakh crores

5) 12, 1.87 Lakh croresAns: 3

Solution:

In 2020, the central government introduced the Production Linked Incentive (PLI) scheme for 14 sectors with a total incentive outlay of Rs 1.97 lakh crore (or about USD 26 billion).

The 14 sectors are mobile manufacturing, manufacturing of medical devices, automobiles and auto components, pharmaceuticals, drugs, specialty steel, telecom & networking products, electronic products, white goods (ACs and LEDs), food products, textile products, solar PV modules, advanced chemistry cell (ACC) battery, and drones and drone components.

The key objective of the PLI schemes is to make domestic manufacturing globally competitive by boosting existing capacities in manufacturing for sunrise (new businesses) and strategic sectors, creating global champions in manufacturing and curbing cheaper imports, while also reducing import bills, enhancing export capacity, and generating employment.

Mint StatiCA MCQs – April 12, 2023

Which of the following statements are correct regarding El-Nino and La Nina?

A. La Nina is an unusual pattern when the water of the eastern tropical Pacific Ocean gets warm.

B. El Nino is the “cool phase” of unusual cooling of the tropical eastern Pacific.

C. Strong El Nino events contribute to weaker monsoons and even droughts in India Southeast Asia.

(1) All A, B and C

(2) Both A and B

(3) Only A

(4) Only B

(5) Only CAns: 5

Solution: El Nino and La Nina are complex weather patterns resulting from variations in ocean temperatures in the Equatorial Pacific Region. El Nino is a unusual pattern when the water of the eastern tropical Pacific Ocean gets warm. La Nina is the “cool phase” of unusual cooling of the tropical eastern Pacific. Strong El Nino events contribute to weaker monsoons and even droughts in India Southeast Asia.The (A) has notified the cost inflation index (CII) number for the current financial year, 2023-24. Identify A.

(1) National Statistics Office

(2) Ministry of Commerce and Industry

(3) NITI Aayog

(4) Central Board of Direct taxes

(5) None of the aboveAns: 4

Solution: The Central Board of Direct Taxes (CBDT) has notified the cost inflation index (CII) number for the current financial year, 2023-24. According to the notification dated April 10, 2023, the CII number for the current fiscal year is 348. This CII number will be used to calculate the capital gains accrued in the current financial year from the sale of long-term assets.

The CII number is used to calculate the indexed or inflation adjusted cost on a long-term asset in order to calculate the capital gains. Once the capital gains are calculated, then income tax payable on such gains is calculated. You will need this CII number at the time of filing the income tax return (ITR) next year i.e., AY 2024-25.The minimum subscription for a public issue shall not be less than (A) percent of the base issue size or as may be specified by SEBI. Identify A.

(1) 25%

(2) 50%

(3) 60%

(4) 75%

(5) 90%Ans: 4

Solution:

The minimum subscription for a public issue shall not be less than 75% percent of the base issue size or as may be specified by SEBI. The requirement of minimum subscription shall not apply to issuers issuing tax-free bonds as specified by the Central Board of Direct Taxes.Which of the following statements are correct regarding Open Network on Digital Commerce (ONDC)?

A. ONDC is to be based on open-sourced methodology, using open specifications and open network protocols independent of any specific platform.

B. Buyer and Seller to use the different platform or application to be digitally visible and do a business transaction.

C. ONDC protocols would standardize operations like cataloguing, inventory management, order management and order fulfilment.

(1) Both A and C

(2) Both B and C

(3) Both A and B

(4) Only A

(5) All A, B and CAns: 1

Solution:

Open Network for Digital Commerce (ONDC) is an initiative aiming at promoting open networks for all aspects of exchange of goods and services over digital or electronic networks. ONDC is to be based on open-sourced methodology, using open specifications and open network protocols independent of any specific platform. The foundations of ONDC are to be open protocols for all aspects in the entire chain of activities in exchange of goods and services, similar to hypertext transfer protocol for information exchange over internet, simple mail transfer protocol for exchange of emails and unified payments interface for payments. These open protocols would be used for establishing public digital infrastructure in the form of open registries and open network gateways to enable exchange of information between providers and consumers. Providers and consumers would be able to use any compatible application of their choice for exchange of information and carrying out transactions over ONDC. Thus, ONDC goes beyond the current platform-centric digital commerce model where the buyer and seller have to use the same platform or application to be digitally visible and do a business transaction. ONDC protocols would standardize operations like cataloguing, inventory management, order management and order fulfilment.(A)_ target strengthens the means of implementation and revitalize the Global Partnership for Sustainable Development. Identify A.

(1) SDG-14

(2) SDG-15

(3) SDG-16

(4) SDG-17

(5) SDG-18Ans: 4

Solution: UN SDG-17 target strengthens the means of implementation and revitalize the Global Partnership for Sustainable Development.

Mint StatiCA MCQs – April 11, 2023

Preference shares are the shares of a company’s stock where dividends are paid out to shareholders before common stock dividends are issued. At present preference shares can be issued for a maximum period of A.

Identify A.

(1) 5 years

(2) 10 years

(3) 15 years

(4) 20 years

(5) 25 yearsAns: 4

Solution:

Preferred Stock / Preference shares: Owners of these kinds of shares are entitled to a fixed dividend or dividend calculated at a fixed rate to be paid regularly before dividend can be paid in respect of equity share. They also enjoy priority over the equity shareholders in payment of surplus. But in the event of liquidation, their claims rank below the claims of the company’s creditors, bondholders / debenture holders.

The preference shares issued shall be liable to be redeemed within a period not exceeding 20 years from the date of their issue.Which of the following statements are correct regarding Tax deducted at source (TDS)?

A. Taxes shall be deducted at the rates specified in the relevant provisions of the Act or the second Schedule to the Finance Act.

B. Electronic mode or E-Payment is mandatory for all corporate assesses.

C. Physical Mode of payment is not authorized for payment of TDS.

(1) Both A and C

(2) Only A

(3) Only B

(4) Only C

(5) Both B and CAns: 3

Solution:

The concept of TDS was introduced with an aim to collect tax from the very source of income. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government. The deductee from whose income tax has been deducted at source would be entitled to get credit of the amount so deducted on the basis of Form 26AS or TDS certificate issued by the deductor.

Taxes shall be deducted at the rates specified in the relevant provisions of the Act or the First Schedule to the Finance Act. However, in case of payment to non-resident persons, the withholding tax rates specified under the Double Taxation Avoidance Agreements shall also be considered.

Tax deducted or collected at source shall be deposited to the credit of the Central Government by following modes: Electronic mode: E-Payment is mandatory for All corporate assesses; and All assesses (other than company) to whom provisions of section 44AB of the Income Tax Act, 1961 are applicable. Physical Mode: By furnishing the Challan 281 in the authorized bank branch.Which of the following is true regarding Public and Private Good.

A. Public goods are non-rivalrous, which means the consumption by one does not affect the consumption of another person.

B. Bottled Water is an example of Private good because it is packed and excludable in nature.

C. Public goods can be excludable in nature, which means goods may not be available to every citizen of the country.

(1) All A, B and C

(2) Both B and C

(3) Only A

(4) Both A and B

(5) Both A and CAns: 4

Solution:

The two main criteria that distinguish a public good are that it must be non-rivalrous and non-excludable. Non-rivalrous means that the goods do not dwindle in supply as more people consume them; non-excludability means that the good is available to all citizens.The G20 was founded in A after the Asian financial crisis as a forum for the Finance Ministers and Central Bank Governors to discuss global economic and financial issues. The G20 Summit is held B, under the leadership of a rotating Presidency.

Identify A and B.

(1) 1997, Annually

(2) 1998, Biennially

(3) 1999, Annually

(4) 2000, Biennially

(5) 2001, BienniallyAns: 3

Solution: The G20 was founded in 1999 after the Asian financial crisis as a forum for the Finance Ministers and Central Bank Governors to discuss global economic and financial issues.

The G20 was upgraded to the level of Heads of State/Government in the wake of the global economic and financial crisis of 2007, and, in 2009, was designated the “premier forum for international economic cooperation”.

The G20 Summit is held annually, under the leadership of a rotating Presidency. The G20 initially focused largely on broad macroeconomic issues, but it has since expanded its agenda to inter-alia include trade, sustainable development, health, agriculture, energy, environment, climate change, and anti-corruption.As per the e-way bill rules, e-way bill is required to be carried along with the goods at the time of transportation if the value is more than _.

(1) Rs 50,000

(2) Rs 1 lakh

(3) Rs 2 lakh

(4) Rs 1.5 Lakh

(5) Rs 3 LakhAns: 1

Solution:

As per the e-way bill rules, e-way bill is required to be carried along with the goods at the time of transportation, if the value is more than Rs. 50,000/-. Under this circumstance, the consumer can get the e-way bill generated from the taxpayer or supplier, based on the bill or invoice issued by him. The consumer can also enroll as citizen and generate the e-way bill himself.

Mint StatiCA MCQs – April 10, 2023

As per WTO’s agreement on agriculture, any kind of support that distorts the production and trade, lies in ______?

1. Red Box

2. Green Box

3. Amber Box

4. Blue Box

5. Orange BoxAns: 3

Solution:

Nearly all domestic support measures considered to distort production and trade (with some exceptions) fall into the amber box, which is defined in Article 6 of the Agriculture Agreement as all domestic supports except those in the blue and green boxes. These include measures to support prices, or subsidies directly related to production quantities. These supports are subject to limits. “De minimis” minimal supports for both product-specific and non-product-specific support are allowed, defined as a share of the value of agricultural production. This threshold is generally 5% of the value of agricultural production for developed countries, 10% for most developing countries — although some WTO members agreed to a different level when they negotiated to join the WTO.Who among the following recommends Minimum Support Price for mandated crops?

Commission for Agricultural Costs & Prices (CACP)

Cabinet Committee on economic affairs

Prime Minister’s Office

Department of Agricultural and Farmers Welfare

NABARDAns: 1

Solution: The Commission for Agricultural Costs & Prices (CACP since 1985, earlier named as Agricultural Prices Commission) came into existence in January 1965. It is mandated to recommend minimum support prices (MSPs) to incentivize the cultivators to adopt modern technology and raise productivity and overall grain production in line with the emerging demand patterns in the country. As of now, CACP recommends MSPs of 23 commodities, which comprise 7 cereals (paddy, wheat, maize, sorghum, pearl millet, barley and ragi), 5 pulses (gram, tur, moong, urad, lentil), 7 oilseeds (groundnut, rapeseed-mustard, soyabean, seasmum, sunflower, safflower, nigerseed), and 4 commercial crops (copra, sugarcane, cotton and raw jute).The National Financial Reporting Authority (NFRA) was constituted on 01st October, __ by the Government of India under the Companies Act.

2017, Banking Regulation Act

2018, Companies Act

2019, National Financial Reporting Act

2020, Banking regulation act

2017, Banking regulation actAns: 2

Solution: The National Financial Reporting Authority (NFRA) was constituted on 01st October,2018 by the Government of India under Sub Section 1 of section 132 of the Companies Act, 2013.

As per Sub Section 2 of Section 132 of the Companies Act, 2013, the duties of the NFRA are to:

Recommend accounting and auditing policies and standards to be adopted by companies for approval by the Central Government; Monitor and enforce compliance with accounting standards and auditing standards; Oversee the quality of service of the professions associated with ensuring compliance with such standards and suggest measures for improvement in the quality of service; Perform such other functions and duties as may be necessary or incidental to the aforesaid functions and duties.Which of the following statements are correct about Project Tiger?

A. It is a centrally sponsored scheme, launched in 1973.

B. It was made a statutory mandate under the biodiversity act 2002.

C. The Jim Corbett Tiger Reserve in Uttarakhand was India’s first tiger reserve.

Only A

Only B

Both B and C

Both A and B

Both A and CAns: 5

Solution: Project Tiger was established in 1973. It was one of the most significant conservation efforts launched in India to protect tigers. Project Tiger was made statutory mandate after amending Wildlife Protection Act 1972. The Jim Corbett Tiger Reserve in Uttarakhand was India’s first tiger reserve.Which of the following statements are not correct about Finance commission?

A. The share of states in the central taxes for the 2021-26 period is recommended to be 41%, same as that for 2020-21.

B. Commission used the population data of 1971 while making recommendations.

C. Forest Cover criteria replaced the erstwhile Forest and Ecology criteria.

Only A

Only B

Both A and B

Both B and C

Both A and CAns: 4

Solution: The Finance Commission is a constitutional body formed by the President of India to give suggestions on centre-state financial relations. The 15th Finance Commission (Chair: Mr. N. K. Singh) was required to submit two reports. The first report, consisting of recommendations for the financial year 2020-21, was tabled in Parliament in February 2020. The final report with recommendations for the 2021-26 period was tabled in Parliament on February 1, 2021.

The share of states in the central taxes for the 2021-26 period is recommended to be 41%, same as that for 2020-21. This is less than the 42% share recommended by the 14th Finance Commission for 2015-20 period. The adjustment of 1% is to provide for the newly formed union territories of Jammu and Kashmir, and Ladakh from the resources of the centre.

Mint StatiCA MCQs – April 6, 2023

Which of the following statements are correct about Standard deposit facility rate?

a. It is a collateral-free instrument.

b. It is used to absorb excess liquidity from the market.

c. The SDF scheme would be open to all participants in the liquidity adjustment facility (LAF).

1. Only a

2. Only b

3. Both a and b

4. All a, b and c

5. Both a and cThe correct answer is All a, b, and c. The standing deposit facility is a collateral-free liquidity absorption mechanism implemented by the RBI with the intention of transferring liquidity out of the commercial banking sector and into the RBI. It enables the RBI to take liquidity (deposits) from commercial banks without having to compensate them with government securities.

Which Ministry infrastructure status to various sub-sectors? With infrastructure status, the sector is entitled to several benefits and concessions.

a. Ministry of Corporate Affairs

b. Ministry of Commerce and Industry

c. Ministry of Finance

d. Ministry of Home Affairs

e. None of the aboveThe correct answer is C. Ministry of Finance grants Infrastructure status which entitles the sector to get financial and other benefits.

__ is the process of separating a standard coupon-bearing bond into its individual coupon and principal components. For example, a 5-year coupon bearing (Government) bond (with half yearly coupon payment) can be stripped into 10 coupons and one principal instrument, all of which thenceforth would become zero coupon bonds.

a. Indexing

b. Stripping

c. Simulating

d. Denting

e. MixingStripping is the process of separating a standard coupon-bearing bond into its individual coupon and principal components.

There are _ Major ports in India. The Indian ports and shipping industry play a vital role in sustaining growth in the country’s trade and commerce.

a. 11

b. 12

c. 13

d. 14

e. 15The correct answer is C, India has 13 major ports, and they play a vital role in sustaining growth in the country’s trade and commerce.

Who is the regulator of India International Bullion Exchange? IIBX offers a diversified portfolio of products and technology services at a cost that is far more competitive than the Indian exchanges as well as other global exchanges.

a. SEBI

b. Ministry of Finance

c. RBI

d. IFSCA

e. State government bodiesThe correct answer is D. International Financial Services Centres Authority (IFSCA) is the regulator of IIBX

Mint StatiCA MCQs – April 5, 2023

Recently, government has cut down __ to nil on crude oil. This tax is imposed when industries experience above average profits due to some economic conditions.

a. Wealth Tax

b. Windfall Tax

c. Capital Gains Tax

d. Environmental Tax

e. Customs dutyThe correct answer is B. Windfall tax is a higher tax rate on profits that ensue from a sudden windfall gain to a particular company or industry due to some economic conditions.

The SENSEX is India’s most tracked bellwether index. It is designed to measure the performance of the A largest, most liquid and financially sound companies across key sectors of the Indian economy that are listed at B.

Identify A and B.

a. 30, National Stock Exchange

b. 60, Bombay Stock Exchange

c. 30, National Stock Exchange

d. 30, Bombay Stock Exchange

e. None of the aboveThe BSE SENSEX is a free-float market-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange.

Which of the following deductions are not available under section 80(C) of Income tax act?

a. Equity Linked Savings scheme.

b. Tuition fee for only 1 child

c. NHB Deposit scheme

1. Only a

2. Only b

3. Only c

4. Both a and b

5. Both a and cThe correct answer is only B. Tuition fee can be for 2 children as well. Both ELSS and NHB Deposit scheme are eligible for tax deductions under section 80(C) of Income Tax Act.

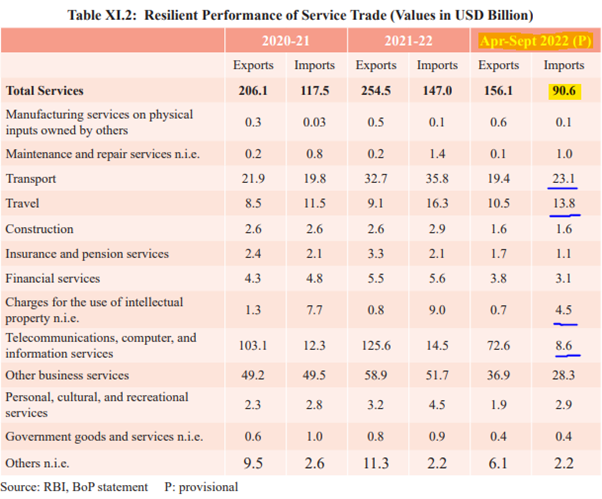

As per the Economic Survey 2022-23, total services import was 90.6 USD Billion between April and Sept 2022. What is the correct order of items imported in services between April and September 2022?

a. Charges for Intellectual property < Telecommunications < Transport < Travel

b. Telecommunications < Charges for Intellectual property < Travel < Transport

c. Charges for Intellectual property < Transport < Telecommunications < travel

d. Charges for Intellectual property < Telecommunications < travel < Transport

e. Travel < Transport < Charges for Intellectual property < TelecommunicationsThe correct answer is D.

Which of the following portal is used to analyse import-export trade of India and other countries where interested parties can get crucial information about India’s international commerce.

a. BHUVAN Portal

b. NIPUN Portal

c. NIRYAT Portal

d. NISCHAY Portal

e. SRIJAN PortalThe correct answer is C. NIRYAT stands for National Import-Export Record for Yearly Analysis of Trade. Through this portal, parties can get crucial information about India’s international commerce.

Mint StatiCA MCQs – April 4, 2023

As per the United Nations Sustainable Development goals, the SDG goal _ indicates about making cities inclusive, safe, resilient and sustainable.

a. Goal-8

b. Goal-9

c. Goal-10

d. Goal-11

e. Goal-12The correct answer is D. Sustainable Development Goal 11, titled “sustainable cities and communities”, is one of 17 Sustainable Development Goals established by the United Nations General Assembly in 2015. The official mission of SDG 11 is to “Make cities inclusive, safe, resilient and sustainable

Which of the statements are correct about Purchasing Managers Index?

1) It is a leading indicator.

2) It is released by S&P Global.

3) Readings above 50 signal an improvement over previous month.

a. Only a

b. Only b

c. Only c

d. Both a and c

e. All of the aboveThe correct answer is E. Purchasing Managers’ Index™ (PMI™) is a survey-based economic indicator designed to provide a timely insight into business conditions. It is released by S&P Global. These indexes therefore vary between 0 and 100 with levels of 50.0 signaling no change on the previous month. Readings above 50.0 signal an improvement or increase on the previous month. Readings below 50.0 signal a deterioration or decrease on the previous month.

Which of the following countries is not a member country of OPEC Nations?

a. Iraq

b. Russia

c. Algeria

d. Nigeria

e. VenezuelaThe correct answer is B. The Organization of the Petroleum Exporting Countries (OPEC) was founded in Baghdad, Iraq, with the signing of an agreement in September 1960 by five countries namely Islamic Republic of Iran, Iraq, Kuwait, Saudi Arabia and Venezuela. They were to become the Founder Members of the Organization. Currently, it has 13 members. Russia is not a part of OPEC organization. However, OPEC+ is the group of oil exporters that includes countries like Oman, Azerbaijan and Russia.

Competition commission of India is a A body responsible for enforcing the competition act B.

Identify A and B.

a. Constitutional, 2002

b. Statutory, 2003

c. Constitutional, 2003

d. Statutory, 2002

e. None of the aboveThe correct answer is D. The Competition Act, 2002, as amended by the Competition (Amendment) Act, 2007, follows the philosophy of modern competition laws. The Act prohibits anti-competitive agreements, abuse of dominant position by enterprises and regulates combinations (acquisition, acquiring of control and M&A), which causes or likely to cause an appreciable adverse effect on competition within India.

Which of the following is not a mission outcome by 2030 projected by National green hydrogen mission?

a. Production capacity of 5mmt

b. Over eight lakh crores in total investments

c. Creation of over six lakh jobs

d. Abatement of nearly 50MMT of annual greenhouse gas emissions

e. All of the aboveThe correct answer is E. India has set its sight on becoming energy independent by 2047 and achieving Net Zero by 2070. To achieve this target, increasing renewable energy use across all economic spheres is central to India’s Energy Transition. Green Hydrogen is considered a promising alternative for enabling this transition. Hydrogen can be utilized for long-duration storage of renewable energy, replacement of fossil fuels in industry, clean transportation, and potentially also for decentralized power generation, aviation, and marine transport.

Mint StatiCA MCQs – April 3, 2023

World Bank consists of two entities International Bank for Reconstruction and Development and A. Where each member receives votes based on their subscription. Currently, in IBRD, India holds less than B of total voting power whereas the USA holds 15.45%.

Identify “A” and “B” respectively.

a.) International Development Association, 1%

b.) International Finance Corporation, 1%

c.) International Development Association, 4%

d.) Multilateral Investment Guarantee Agency (MIGA), 2%

e.) International Development Association, 3%The correct answer is C. The World Bank is the collective name for the International Bank for Reconstruction and Development (IBRD) and International Development Association (IDA), two of five international organizations owned by the World Bank Group. As on 31st March 2023, India holds 3.01% of the total voting power.

Under Section 45ZB of the RBI Act, 1934 provides for an empowered ¬A members monetary policy committee (MPC) to be constituted by the Central Government. The MPC is required to meet at least ¬¬B times a year. The quorum for the meeting of the MPC is four members.

Identify “A” and “B” respectively.

a.) 4, 6

B.) 4, 4

C.) 4, 8

d.) 6, 4

e.) 6, 6The correct answer is D. Section 45ZB of the amended RBI Act, 1934 provides for an empowered six-member monetary policy committee (MPC) to be constituted by the Central Government by notification in the Official Gazette. The first such MPC was constituted on September 29, 2016. The MPC is required to meet at least four times a year. The quorum for the meeting of the MPC is four members.

Which of the following is correct about the RoDTEP (Remission of Duties and Taxes on Exported) Scheme?

a.) It was announced in September 2020.

b.) It replaced the earlier Merchandise Exports from India Scheme (MEIS).

c.) It is not a WTO-compliant scheme.

1.) Both b and c

2.) Only b

3.) Both a and b

4.) Only c

5.) Both a and cRoDTEP (Remission of Duties and Taxes on Exported) Scheme was launched in September 2019 to replace the earlier Merchandise Exports from India Scheme (MEIS). It is a WTO Compliant scheme.

What does “R” denote in CERT-IN, a nodal agency setup in 2004 in the domain of cybersecurity?

a.) Resource

b.) Response

c.) Register

d.) Refresh

e.) None of the aboveThe correct answer is B. The Indian Computer Emergency Response Team is an office within the Ministry of Electronics and Information Technology of the Government of India. It is the nodal agency to deal with cyber security threats like hacking and phishing. It strengthens the security-related defence of the Indian Internet domain.

Fundraising via REITs, InvITs drop to an all-time low in FY23. Which of the following Entities regulates these two instruments?

a.) RBI

b.) Ministry of Finance

c.) SEBI

d.) NHB

e.) Both c and dThe correct answer is C. Securities and Exchange Board of India regulates both Real estate Investment Trusts (REITs) and Infrastructure Investment trusts (InvITs).

Click Here for Previous Months’ Mint StatiCA

- Sign Up on Practicemock for Updated Current Affairs, Free Topic Tests and Free Mini Mocks

- Sign Up Here to Download Free Study Material

Free Mock Tests for the Upcoming Exams

- IBPS PO Free Mock Test

- RBI Grade B Free Mock Test

- IBPS SO Free Mock Test

- NABARD Grade A Free Mock Test

- SSC CGL Free Mock Test

- IBPS Clerk Free Mock Test

- IBPS RRB PO Free Mock Test

- IBPS RRB Clerk Free Mock Test

- RRB NTPC Free Mock Test

- SSC MTS Free Mock Test

- SSC Strenographer Free Mock Test

- GATE Mechanical Free Mock Test

- GATE Civil Free Mock Test

- RRB ALP Free Mock Test

- SSC CPO Free Mock Test

- AFCAT Free Mock Test

- SEBI Grade A Free Mock Test

- IFSCA Grade A Free Mock Test

- RRB JE Free Mock Test

- Free Banking Live Test

- Free SSC Live Test