Preparing well for the RBI Grade B exam means not just working hard but also investing sufficient time in each subject. Current Affairs is one of the most important sections, especially in the General Awareness part of Phase 1. And Phase 2 tests it even more thoroughly, especially in ESI and FM papers. In Phase 1, this section can easily test you with 20 to 25 questions. In contrast, in Phase 2, many questions are based on recent government schemes, economic updates, and reports. An up-to-date knowledge of current affairs can help you maximize your score quickly, improve your accuracy, and increase your chances of outperforming others. In this blog, we’ll not just share with you the best this to master the art of covering daily Current Affairs, but also the best resources to make your goal easier to reach.

Read to know How To Tackle General Awareness Section For RBI Grade B Exam?

Also, go through RBI Grade B General Awareness Preparation Strategy 2025

How to Manage Time for Current Affairs Preparation

Many candidates, especially those who are preparing for the RBI Grade B exam for the first time, often wonder how much time they should give daily to current affairs preparation. Along with this, they are also unsure about which resources can make their preparation easier. For such candidates, we have shared some of the most effective tips below, which will help them fully understand and master the current affairs section.

1. Give 1 Hour Daily to Current Affairs

Mastering Current Affairs is very easy, but for that, you need to dedicate time to its preparation every day. Most importantly, you need to follow a fixed daily routine. This schedule will help you stick to the plan and reduce last-minute pressure.

Here’s what you should do:

- Read daily current affairs for 45 to 60 minutes

- Use monthly PDFs to stay up-to-date knowledge of current affairs

- Cover at least the last 6 months of Current Affairs for the Phase 1 Exam

- Focus on schemes, reports, and RBI circulars for the Phase 2 Exam

- Do revisions every week to remember important facts

2. Make Notes While Reading

Notes are effective tools. You can save your precious time, especially during revision. It will not only aid you in revising quickly but also improve your memory.

Try this method:

- Make concise notes for each topic (make a list of the highlights of topics)

- Break content into bullet points for easy understanding

- Maintain separate notebooks for Phase 1 and Phase 2

- Highlight all the important government schemes and economic terms

- Use highlighters or digital tools

3. Use Reliable Sources Only

You should only study from authentic sources. You don’t need to overthink this that if you prepare using poor sources or resources (such as books and online courses), your results will also be poor. Therefore, it is essential to choose quality resources that are recommended by subject experts. So, make sure you’re reading only what’s needed for the exam.

Stick to these:

- Read PIB summaries and official government websites

- Follow RBI circulars regularly

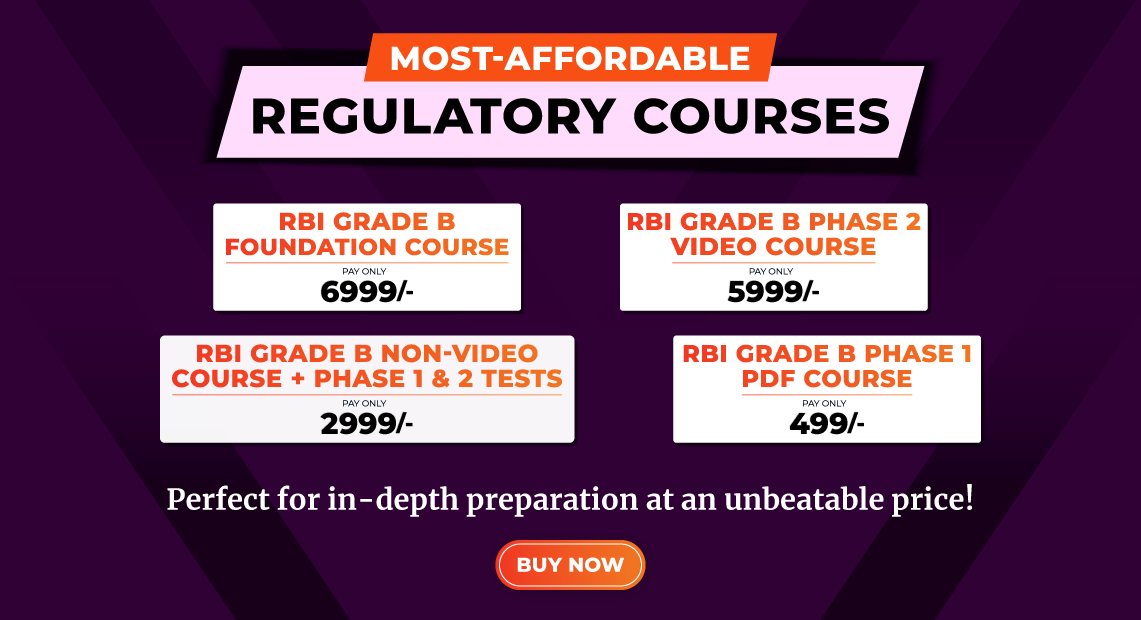

- Use trusted apps like PracticeMock.

- Don’t follow too many sources

- Avoid outdated materials

Click here to Get Banking Current Affairs PDF via Bazooka: Download for Free

Click on the Banner below & Check Out The best Foundation Course for Complete Preparation for Toppers

4. Revise Regularly to Retain Facts

You can easily forget current affairs without revision. Revision is the best method for remembering everything. Therefore, whatever you study, make notes of it and revise them the next day.

Make this a habit:

- Revise weekly and monthly

- Use quizzes to test your memory

- Take monthly PDF revisions

- Read the notes you made on your own, as per your preferences

- Practice questions daily

5. Focus More Before the Exam

The last 2 months are very important for revision and practice. So, it’s essential to give more time to the revision of all the topics that you have already learned. And more so, when there are just a few days left for the exam. So, you should plan your revision like this:

- Revise for at least 2 hours daily in the final 60 days

- Focus on banking, economy, and government updates

- Attempt full-length mock tests

- Analyse your performance

- Practice time-bound quizzes

Takeaway

Giving the right time daily to current affairs and revising regularly can really improve your RBI Grade B score. Try to study for at least 1 hour every day and revise what you learned every week. Stay regular and avoid last-minute study. Also, take mock tests often. They help you practice in exam-like conditions, find your mistakes, and improve speed and accuracy. Joining a good online course can also help. It gives you proper notes, daily updates, and expert tips. With regular practice, revision, mock tests, and the right support, you can do really well in this section.

Join our unique Telegram group immediately to skyrocket your preparation for Regulatory exams via expert guidance, top tips, perfect feedback, and much more!

[ Click Here to join the PracticeMock Telegram Group! ]

[ Click Here to join the PracticeMock Telegram Discussion Group Link! ]

Also, go through the 60 days Study Plan for the RBI Grade B Exam 2025

Related Posts:

FAQs

At least 6 months before the exam is recommended.

No, it carries high weightage and is important to clear the cutoff.

Yes, if read consistently and revised properly.

Revise weekly and take quizzes regularly.

PIB, RBI website, and trusted apps like PracticeMock.

- Sign Up on Practicemock for Updated Current Affairs, Free Topic Tests and Free Mini Mocks

- Sign Up Here to Download Free Study Material

Free Mock Tests for the Upcoming Exams

- IBPS PO Free Mock Test

- RBI Grade B Free Mock Test

- IBPS SO Free Mock Test

- NABARD Grade A Free Mock Test

- SSC CGL Free Mock Test

- IBPS Clerk Free Mock Test

- IBPS RRB PO Free Mock Test

- IBPS RRB Clerk Free Mock Test

- RRB NTPC Free Mock Test

- SSC MTS Free Mock Test

- SSC Strenographer Free Mock Test

- GATE Mechanical Free Mock Test

- GATE Civil Free Mock Test

- RRB ALP Free Mock Test

- SSC CPO Free Mock Test

- AFCAT Free Mock Test

- SEBI Grade A Free Mock Test

- IFSCA Grade A Free Mock Test

- RRB JE Free Mock Test

- Free Banking Live Test

- Free SSC Live Test