Indian Currency System

Currency System In India: As we all know, the Indian rupee is the currency that we use in our country. One rupee (symbol -> ₹) is equal to 100 paise (singular -> paisa). The Reserve Bank of India (RBI) is the central bank of the country and is responsible for the issuance and distribution of currency in our country. In this blog, we have provided all the important details related to the currency system in India to help those candidates who are preparing for the Banking, SSC, and other government exams. So, read this blog carefully to know the currency system in India.

Currency System in India

The Paper Currency Act of 1861 conferred upon the Government of India the monopoly of note issues, thus ending the practice of private and presidency banks issuing currency. Between 1861 and 1935, the Government of India managed the issue of paper currency. In 1935, when the Reserve Bank started operations, it took over the function of note issue from the Office of the Controller of Currency, Government of India.

Indian Money System

Management of currency is one of the core central banking functions of the Reserve Bank of India. The Reserve Bank of India, along with the Government of India, is responsible for the design, production, and overall management of the nation’s currency. In consultation with the Government, the Reserve Bank routinely addresses security issues and targets ways to enhance security features to reduce the risk of counterfeiting or forgery of currency notes.

Features of Bank Notes

Here we have provided the features of bank notes which explains the notes about their size, color, and structure explain the front and back notes.

1. Coins

There are various coins in use in India they come in different sizes and values as follows; ₹ 1, ₹ 2, ₹ 5 and ₹ 10. Coins are mainly used in small transactions in day-to-day activities. In the past years and even centuries, there is discovered that metal used in minting coins and the general pattern of the coins has varying features, however the coins have never left the circulation system.

2. Banknotes

Currently, there are legal tender available in notes in ₹10, ₹20, ₹50, ₹100, ₹200, ₹500, etc. These banknotes have their looks and designing differ and sometimes depict on the Indian cultural values.

Features of Rs. 500 Bank Note

| Category | Details |

| Color | Stone Grey |

| Size | 66mm × 150mm |

| Observe | – Portrait of Mahatma Gandhi at the Centre – Ashoka Pillar emblem on the right |

| Reserve | – Red Fort with Indian Flag – Swachh Bharat logo with slogan |

Features of Rs. 200 Bank Note

| Category | Details |

| Color | Bright Yellow |

| Size | 66mm × 146mm |

| Observe | – Portrait of Mahatma Gandhi at the Centre – Ashoka Pillar emblem on the right |

| Reserve | – Motif of Sanchi Stupa – Swachh Bharat logo with slogan |

Features of Rs. 100 Bank Note

| Category | Details |

| Color | Lavender |

| Size | 66mm × 142mm |

| Observe | – Portrait of Mahatma Gandhi at the Centre – Ashoka Pillar emblem on the right |

| Reserve | – Motif of Rani ki Vav – Swachh Bharat logo with slogan |

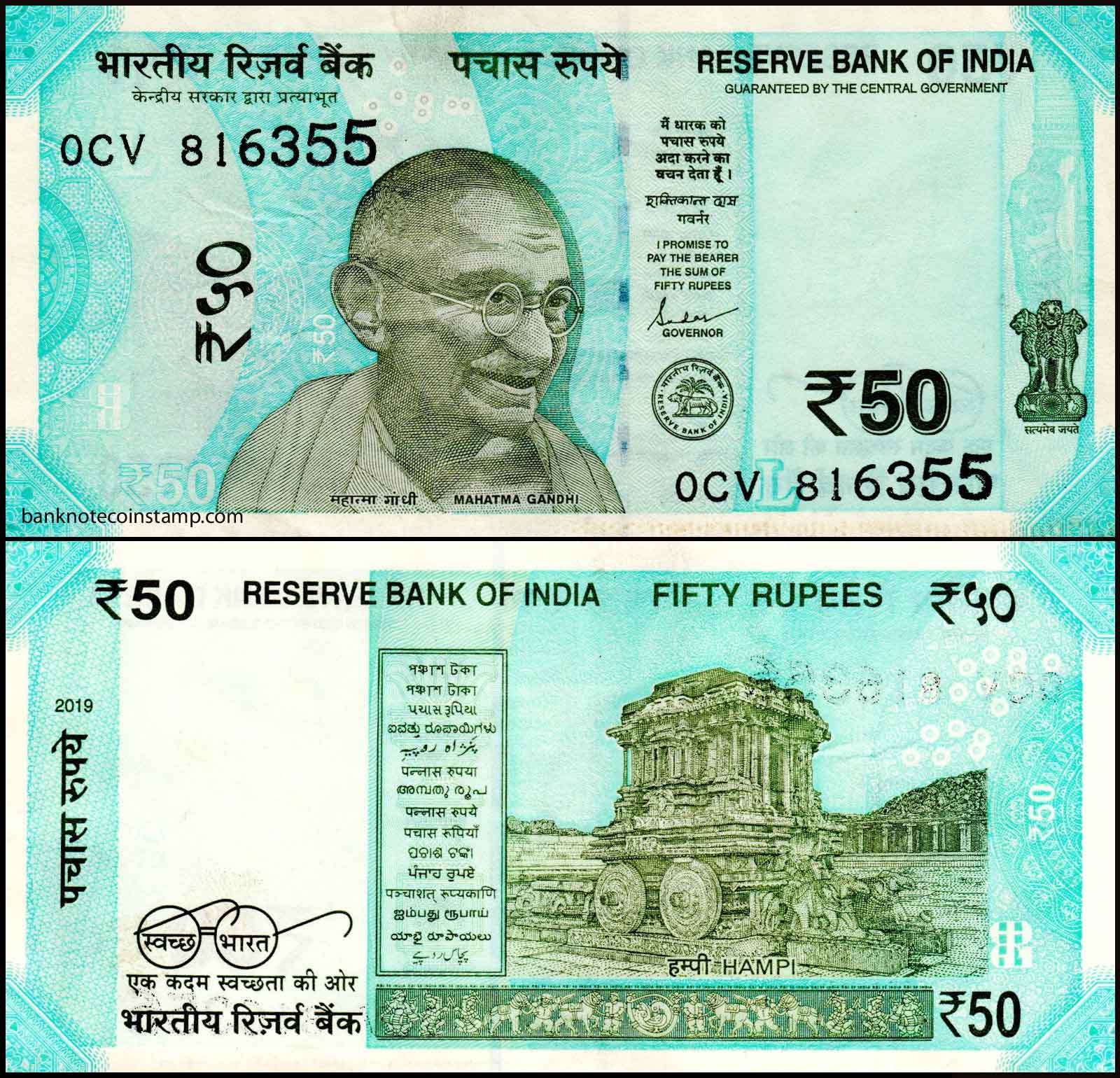

Features of Rs. 50 Bank Note

| Category | Details |

| Color | Lavender |

| Size | 66mm × 135mm |

| Observe | – Portrait of Mahatma Gandhi at the Centre – Ashoka Pillar emblem on the right |

| Reserve | – Motif of Hampi with Chariot – Swachh Bharat logo with slogan |

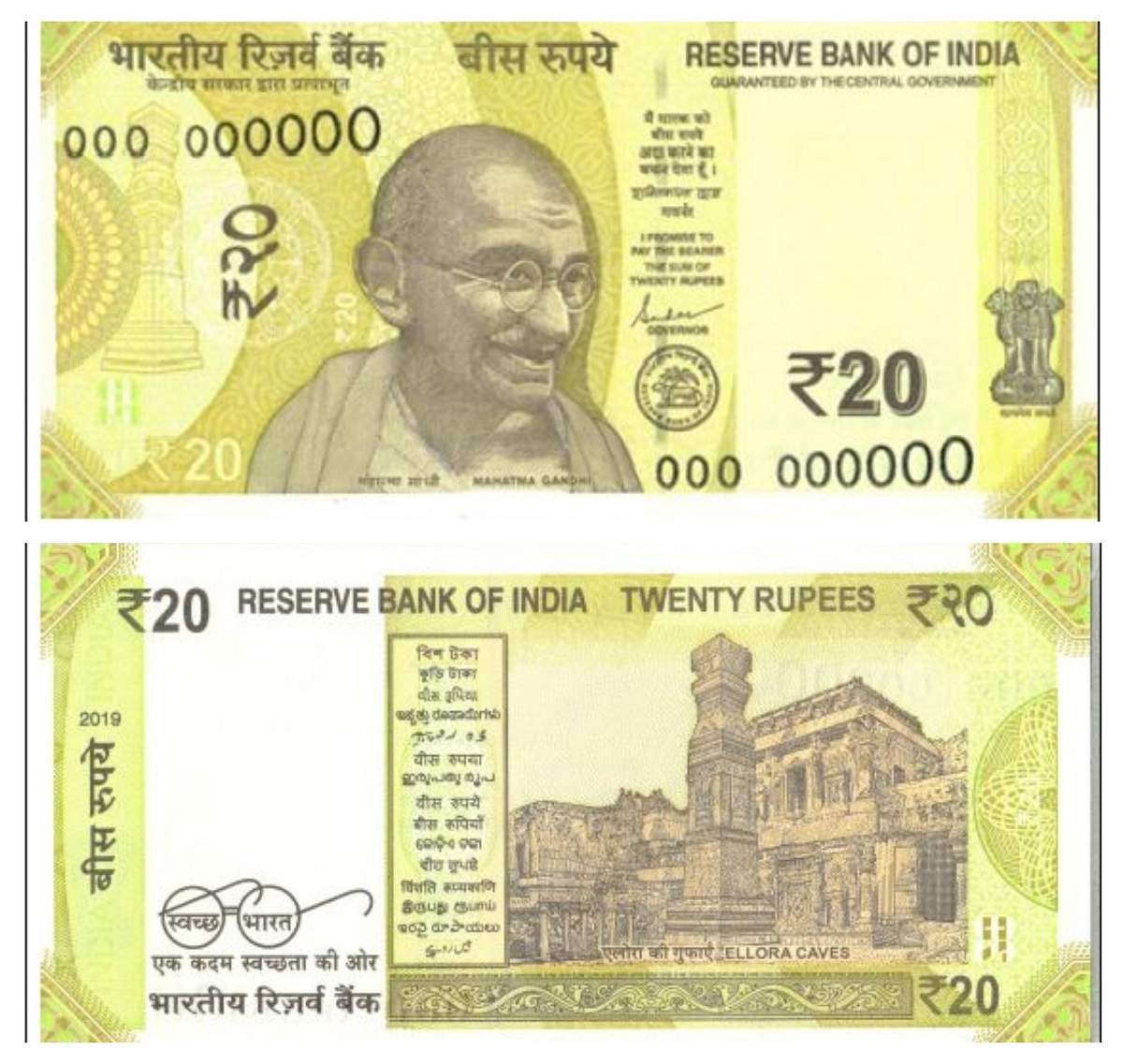

Features of Rs. 20 Bank Note

| Category | Details |

| Color | Greenish Yellow |

| Size | 63mm × 129mm |

| Observe | – Portrait of Mahatma Gandhi at the Centre – Ashoka Pillar emblem on the right |

| Reserve | – Motif of Ellora Caves – Swachh Bharat logo with slogan |

Features of Rs. 10 Bank Note

| Category | Details |

| Color | Chocolate Brown |

| Size | 63mm × 123mm |

| Observe | – Portrait of Mahatma Gandhi at the Centre – Ashoka Pillar emblem on the right |

| Reserve | – Motif of ‘Sun Temple, Konark’ – Swachh Bharat logo with slogan |

Evolution of the Indian Currency System

The monetary system of India has been experiencing evolution, right from the prehistoric era, but has gone through more changes in the last two decades. Kept as one of the most important changes of the time was the Demonetization of 2016. Despite its pros, on November 8, 2016, the Government of India in order to suppression the evils of black money, fake currency and terrorism announced demonetization of ₹500 and ₹1000 currency notes. These high denomination notes have been replaced with new ₹ 500 and ₹ 2000 notes. The otherwise move was to encourage the elimination of the use of physical cash in circulation and increase the sales of digital products.

Digital Currency and Financial Inclusion

Here we have provided some key aspects of the digital currency system in India:

1. Unified Payment Interface (UPI)

National Payments Corporation of India (NPCI) has launched the UPI system to revolutionized the Indian digital payments space. Due to UPI it become convenient to transfer amount from one bank account to the other simply via smartphone. It has displaced the physical cash and is the most popular form of digital transaction in the country.

2. Mobile Wallets

Other payment methods such as Mobile Wallet like Paytm, PhonePe and Google Pay are also much popular nowadays. These are applications where people can keep money in a virtual format and pay for different services we use, from utilities to goods and even send money to friends and family.

3. Government Initiatives

The Government of India and other relevant authorities have put effort into designing various innovative policies for financial inclusion and a digital economy. The ‘Financial Inclusion Scheme’-Jan Dhan Yojana ‘, Aadhaar base payment system’, the DBT payments have made it possible for millions of Indians to have bank facilities which is useful for the country’s people in the rural areas to perform digital transactions.

Challenges Facing India’s Currency System

Despite the robust framework, the Indian currency system faces several challenges:

- Counterfeit Currency: However, one old problem that has manifested in different dimensions is counterfeiting, especially with high-denomination regime. Despite repeated efforts RBI has initiated several new security features on a currency note, there are methods adopted by fraudsters and fakers.

- Inflation: Inflation leads to depreciation of the currency in the market over some time. RBI keeps track of inflation rates in a specific time period and employs monetary policy measures in order to make the rupee’s purchasing power at par with other international currency.

- Currency Fluctuations: As with any world currency, the Indian Rupee has an unpredictable value in the foreign exchange market. Things like foreign investments, trade deficits and conflicts in the global arena can lead to changes in the exchange rates of the rupee for example with the US Dollar.

Banking Mock Test

Currency System In India: FAQs

The official currency of India is the Indian Rupee, symbolized as ₹.

The Reserve Bank of India (RBI) is responsible for issuing and managing currency in India.

The new ₹500 note was introduced after demonetization in November 2016.

Indian notes have security features like watermarks, security threads, micro-lettering, and latent images to prevent counterfeiting.

The color of the ₹500 note is stone grey.

- Sign Up on Practicemock for Updated Current Affairs, Free Topic Tests and Free Mini Mocks

- Sign Up Here to Download Free Study Material

Free Mock Tests for the Upcoming Exams

- IBPS PO Free Mock Test

- RBI Grade B Free Mock Test

- IBPS SO Free Mock Test

- NABARD Grade A Free Mock Test

- SSC CGL Free Mock Test

- IBPS Clerk Free Mock Test

- IBPS RRB PO Free Mock Test

- IBPS RRB Clerk Free Mock Test

- RRB NTPC Free Mock Test

- SSC MTS Free Mock Test

- SSC Strenographer Free Mock Test

- GATE Mechanical Free Mock Test

- GATE Civil Free Mock Test

- RRB ALP Free Mock Test

- SSC CPO Free Mock Test

- AFCAT Free Mock Test

- SEBI Grade A Free Mock Test

- IFSCA Grade A Free Mock Test

- RRB JE Free Mock Test

- Free Banking Live Test

- Free SSC Live Test